BTC and ETH Enter Critical Technical Zones as Market Pressure Mounts

Bitcoin and Ethereum entered deep corrective territory this week, with BTC slipping to 94,000 USD and ETH testing the 3,000 USD level, sending a wave of caution through the market. Fresh chart data shows both assets approaching zones that traders consider historically reactive, raising questions about whether the pullback is a temporary shakeout or the start of a broader trend shift.

Bitcoin Tests Major Demand Zone

Bitcoin’s decline pushed price directly into a high-volume demand region highlighted on the charts. The asset has been trading inside a descending channel since early September, repeatedly rejecting its upper boundary. The most recent breakdown carried BTC into a wide liquidity pocket between 94,000 and 96,000.

BitXJournal Market analyst “a senior derivatives trader” noted that “Bitcoin is revisiting an area where long-term buyers have historically stepped in, but the market structure still shows lower highs forming.”

He added that the next 48 to 72 hours will signal if this zone holds or becomes a gateway to deeper losses.

The charts also show multiple Break of Structure (BOS) signals to the downside alongside failed attempts to reclaim mid-range resistance. A key resistance band remains near 108,000–112,000, marked by previous liquidity sweeps.

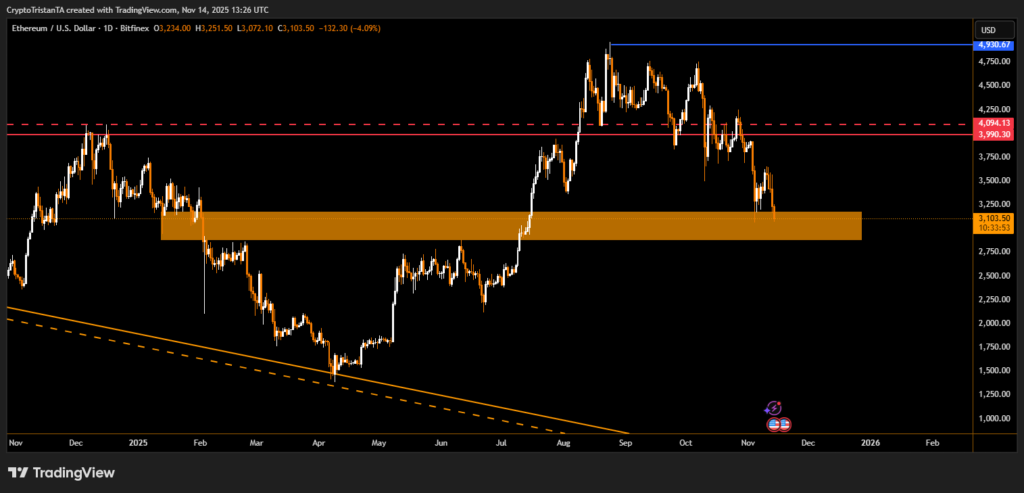

Ethereum Falls Toward Multi-Month Support

ETH mirrored Bitcoin’s weakness, dropping toward 3,000 USD, a level that previously served as a springboard for several major rallies. The orange support area visible on the chart represents a consolidation base dating back to Q1, giving traders a historically reliable technical reference.

A portfolio strategist commented, “Ethereum is testing a structural shelf that aligns with both price memory and volume accumulation. Losing this zone could expose the asset to a deeper retracement toward the high-2,000s.”

BitXJournal Analysts also point to ETH’s repeated rejections from the 4,000 USD region earlier in the quarter, creating a sequence of lower highs consistent with a cooling market.

Both assets now sit at crucial levels where traders tend to watch for absorption or capitulation. While short-term volatility remains elevated, experts agree that holding current demand zones is essential for avoiding steeper corrective moves.

Overall, the market appears to be entering a decisive phase, with Bitcoin and Ethereum at technical crossroads that may shape price action heading into the final months of the year.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.