BTC dips to weekly lows amid weak trading volume, with analysts eyeing a potential move to fill the latest CME futures gap around $107K.

Bitcoin Price Faces Renewed Selling Pressure

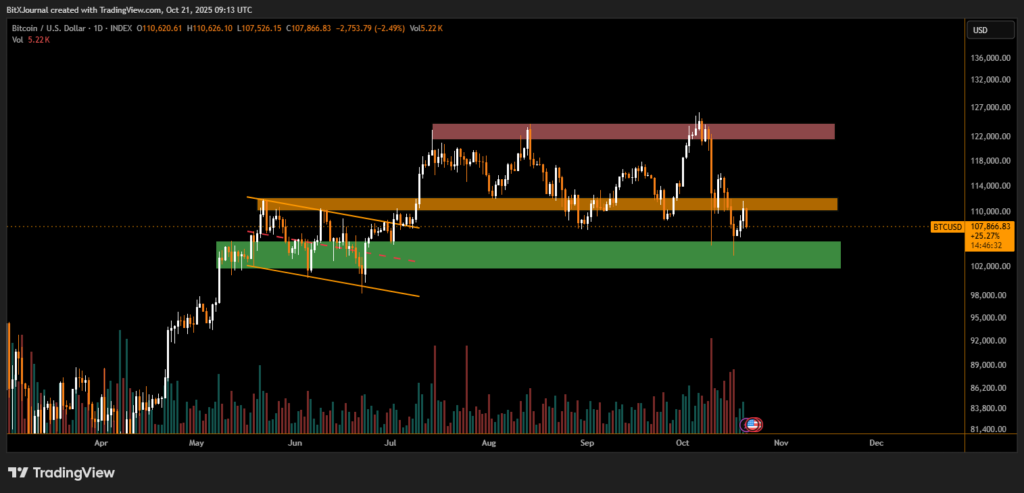

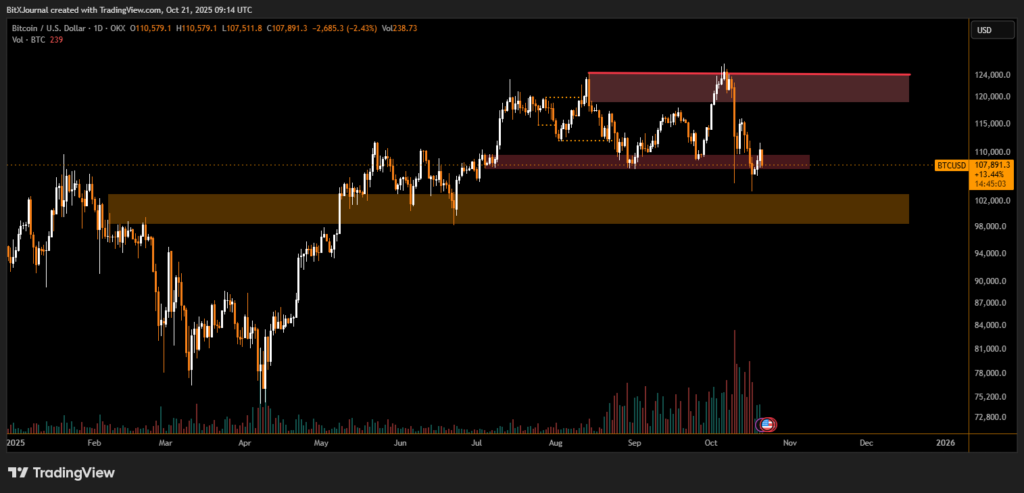

Bitcoin (BTC) fell by 2.5% on Tuesday, slipping to around $107,460 on major exchanges as the market reacted to a possible CME futures gap below current levels. The decline erased early-week gains and revived concerns that $100,000 support could fail if selling continues.

Data from trading platforms shows Bitcoin giving back its short-lived rebound as traders watch the CME Group’s Bitcoin futures chart, where a gap remains unfilled near $107,390. These gaps appear when futures markets close over the weekend and reopen at a different level, often prompting the market to “fill” that space later through price corrections.

“BTC opened with a small CME gap below this week. Price did come down to close some of it, but there’s still a bit left,” trader Daan Crypto Trades explained in a post on X. “Besides that, we did close the big gap at $110K last week that was left at the end of September before BTC rallied to new all-time highs.”

Traders Cautious as Momentum Weakens

Market sentiment remains cautious as volume continues to decline, signaling weakening momentum after Bitcoin’s recent push toward record highs. Daan added that holding $107K is critical for bulls: “If this starts grinding back down and gets close to last Friday’s wick, that’d just show a lot of weakness to me.”

Other traders echoed the concern, noting that the latest rebound lacked sufficient participation to sustain a rally. “Monday’s move had weak volume behind it, suggesting limited buyer conviction,” analyst Roman observed.

$100K Support Under Pressure

While Bitcoin remains up significantly on the year, several analysts warn that a failure to maintain the $107K–$110K zone could open the door for a test of $100,000 support.

Filling the CME gap could serve as a short-term target, but if broader market sentiment doesn’t improve, BTC may revisit six-figure levels that once acted as psychological and technical support.

In summary, Bitcoin’s current dip reflects technical consolidation rather than panic—but the risk of a deeper correction grows if the $107K area fails to hold.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.