Bitcoin Approaches $115K Resistance as Technical Indicators Flash Warning Signs

Bitcoin (BTC) continues to extend its recent rally, climbing above $113,000 after rebounding sharply from weekly lows near $107,800. The recovery reflects renewed buying activity and improved liquidity conditions. Yet, despite the short-term optimism, several technical indicators now point to potential exhaustion — raising the likelihood of a pullback below $110,000 in the near term.

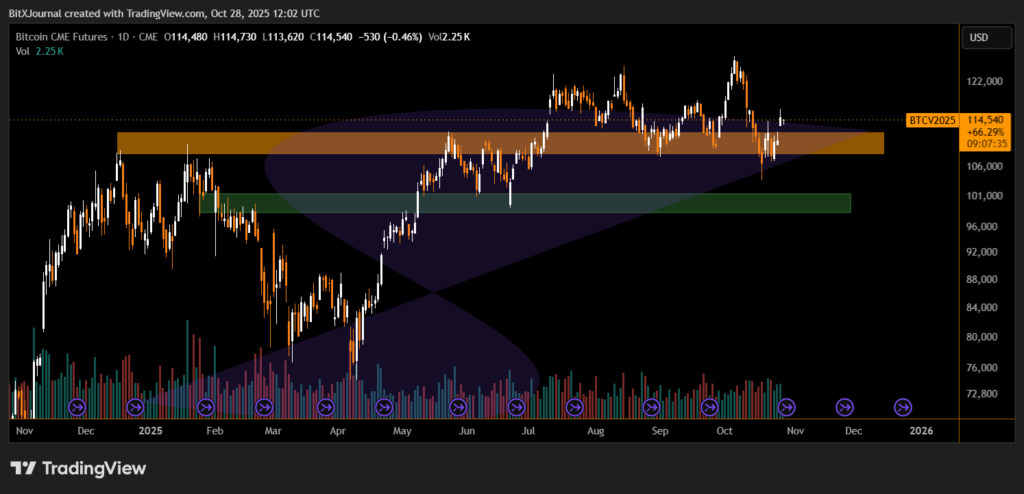

Market participants are watching closely as BTC approaches a key resistance zone between $114,500 and $115,700, an area that has historically triggered profit-taking. If Bitcoin fails to close decisively above this range, a short-term correction may follow.

CME Gap Near $110K Adds Pressure on Bulls

One critical bearish signal stems from a recently formed CME gap, with its lower boundary positioned around $110,000. The gap — spanning $110,700 to $113,500 — has become a focal point for traders, as Bitcoin has a strong historical tendency to “fill” these gaps before establishing a sustained trend.

The Ichimoku Cloud, which now acts as dynamic resistance, aligns with this technical setup. Its upper boundary near $115,700 coincides with the top of the CME gap, creating a strong confluence zone.

“The confluence of resistance levels near $115K, combined with the CME gap, suggests a potential near-term rejection,” noted BitXJournal market analyst. “Unless Bitcoin breaks and holds above this range, the path of least resistance remains lower.”

The broader crypto market remains cautiously optimistic as ETF flows and macroeconomic data continue to influence liquidity. Analysts suggest that a sustained breakout above $115,700 could trigger renewed bullish momentum, potentially lifting altcoins alongside Bitcoin.

However, failure to clear this level may result in range-bound price action, with $110,000 serving as a key defensive zone for bulls.

“If liquidity tightens further, Bitcoin could retest the $110K area to fill the CME gap before resuming its upward trajectory,” said BitXJournal technical strategist.

In short, Bitcoin’s rally remains intact but vulnerable — and the coming sessions could determine whether the market’s next major move heads toward $120,000 or revisits $110,000 support first.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.