Bitcoin Rally Faces First Major Test at $120,000 Level

Bitcoin continues to dominate headlines after surging past $117,000, setting a new all-time high earlier this week. However, the next critical level on traders’ radar is the $120,000 resistance, a psychological barrier reinforced by data from the crypto derivatives market.

With price discovery in full effect, traditional chart-based resistance becomes unreliable. As a result, institutional traders are turning to the options market to identify potential areas of congestion and directional bias.

Options Open Interest Hints at $120K Barrier

On Deribit — the world’s largest crypto options exchange — the $120,000 strike call holds the highest open interest among all Bitcoin options. According to the latest data, this level carries $2.37 billion in open interest, making it the most heavily concentrated strike.

This suggests that a significant number of market participants are anticipating price activity around this level.

Such a dense cluster of open interest can act as a magnet for price in the short term, but also represents a potential ceiling, especially if many of the positions are heavily hedged.

Technical Context Supports Short-Term Resistance

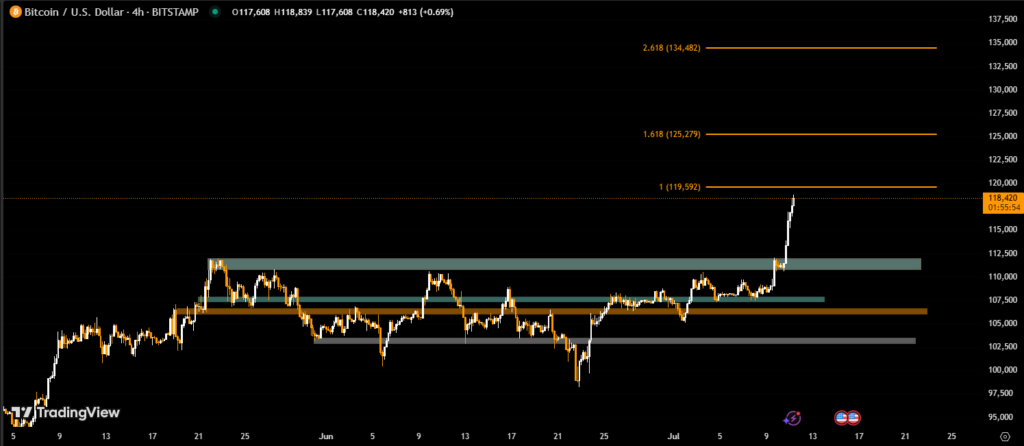

From a technical perspective, Bitcoin has rallied over 15% in the last 7 days, outpacing most risk-on assets. The daily RSI currently sits near 75, indicating that the asset may be entering overbought territory, increasing the chance of temporary pullbacks or consolidations.

Key support lies near $112,000, the previous breakout level. If bulls manage to push above $120,000, the next leg higher could target $125,000 to $130,000, based on Fibonacci extensions.

Institutional Inflows Remain Strong

Supporting this momentum is continued demand for Bitcoin ETFs, with over $1.17 billion in inflows reported on Thursday alone. BlackRock and Fidelity accounted for the bulk of these net investments, indicating that institutional appetite remains high, even at elevated price levels.

$120K Is the Level to Watch

As Bitcoin pushes deeper into uncharted territory, the $120,000 level has emerged as a focal point for both bulls and bears. With record-high open interest at this strike in the options market, it is likely to be a key battleground. Whether Bitcoin breaks through or stalls here may determine the strength and sustainability of the current rally.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.