ETF Outflows and Massive Options Expiry Keep Volatility Elevated

Bitcoin continues to struggle to regain upward momentum, trading near the $87,700 level after repeated failures to break above the critical $90,000 resistance. Weak institutional inflows and a looming derivatives event are keeping traders cautious as short-term risks remain tilted toward volatility rather than direction.

ETF Outflows Weigh on Market Sentiment

Institutional demand has shown clear signs of cooling. US-listed spot Bitcoin ETFs recorded $175.29 million in net outflows in a single day, extending withdrawals to five consecutive sessions. Persistent outflows often reflect reduced risk appetite and can amplify downside pressure during periods of thin liquidity.

Attention is now shifting to derivatives markets, where $23.47 billion worth of Bitcoin options are set to expire. Positioning data shows call contracts outweighing puts, suggesting traders are leaning bullish. However, large expiries frequently trigger sharp price swings, especially around key psychological levels.

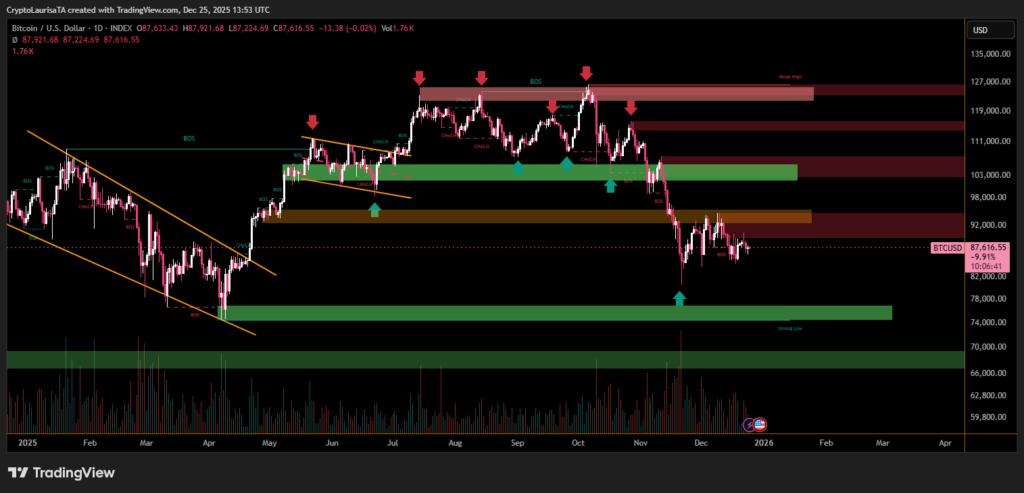

Technical Outlook for Bitcoin Price

Bitcoin failed to hold above $90,000 earlier in the week and has since stabilized below resistance. Momentum indicators show weakening strength,. A deeper pullback could test support near $85,500, while a decisive close above $90,000 may reopen the path toward the $94,000 zone.

With ETF flows negative and derivatives pressure building, Bitcoin remains vulnerable to sudden moves as markets brace for year-end volatility.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.