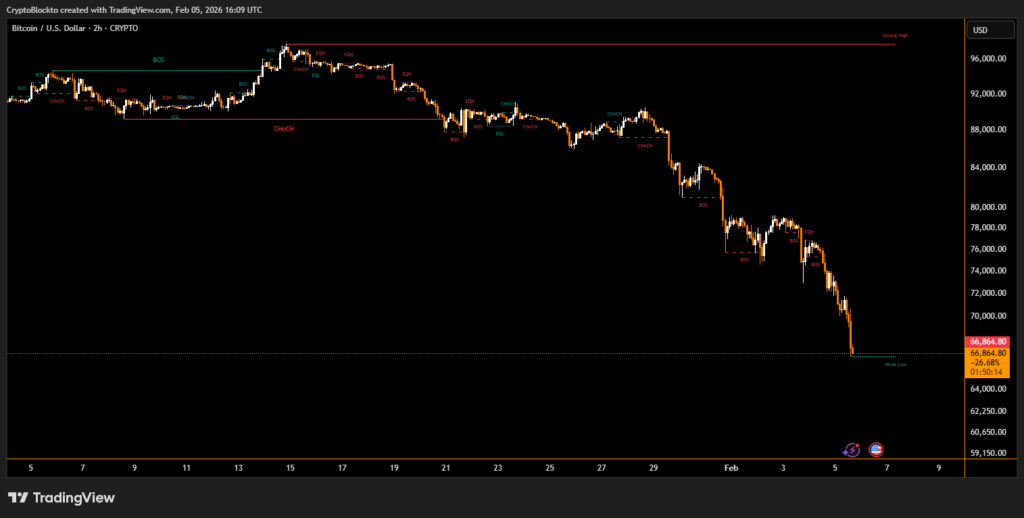

Bitcoin’s recent drop toward the mid-$60,000 range has intensified bearish sentiment, with onchain data suggesting the current downturn is more severe than the early stages of the 2022 bear market. Analysts warn that weakening demand, tightening liquidity, and negative technical signals could push prices lower in the coming months.

At the time of writting $BTC is trading at $66k;

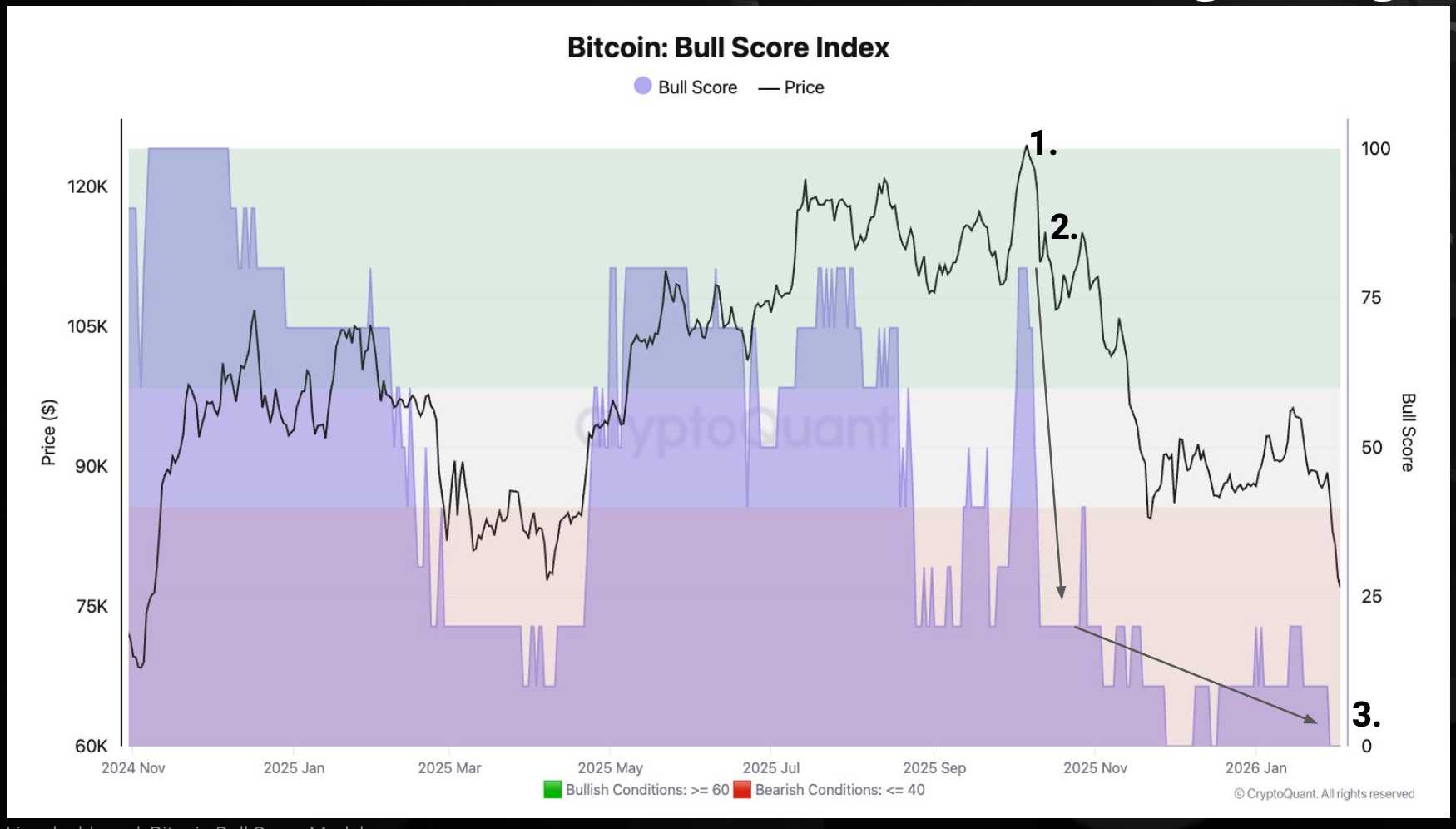

According to CryptoQuant , bitcoin has entered a confirmed bear market phase. A key sentiment metric, the Bull Score Index, has fallen to zero its most pessimistic reading. The index stood near 80 when bitcoin peaked above $120,000 in early October but reversed sharply following a major liquidation event later that month. Analysts now identify a primary support zone between $70,000 and $60,000, with the lower end potentially taking months to reach.

Institutional and Retail Demand Weakens

One of the main pressures on price is a reversal in institutional demand. Spot bitcoin exchange-traded funds in the U.S. have shifted from heavy accumulation last year to net selling in 2026, creating a demand gap of tens of thousands of BTC. Retail participation has also remained muted, with pricing premiums on U.S.-based exchanges staying negative since mid-October — a pattern historically associated with bearish market conditions.

Liquidity and Technical Signals Add Pressure

Market liquidity is tightening as stablecoin supply growth turns negative for the first time in over a year. At the same time, long-term spot demand growth has collapsed by more than 90% over four months. Technically, bitcoin has broken below its 365-day moving average for the first time since 2022, reinforcing expectations that prices could drift toward the $60,000 level.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.