Market sentiment weakens amid long-term holder selloffs and macro uncertainty

Bitcoin’s rally appears to be losing momentum, with multiple analysts suggesting that the world’s largest cryptocurrency is unlikely to hit $125,000 in 2025 — a sharp contrast to the ultra-bullish forecasts made earlier this year.

In early October, prominent figures such as Tom Lee and Arthur Hayes predicted Bitcoin could soar as high as $250,000 by year-end. However, the recent market downturn and fading retail optimism have tempered those expectations.

“We don’t expect crypto to go any higher than $125K USD in 2025,” said Houston Morgan, analyst at ShapeShift. “Bitcoin needs to break free from its correlation with U.S. political cycles — particularly announcements made by President Donald Trump — before another sustainable bull run can occur.”

Bitcoin shows “broader signs of exhaustion”

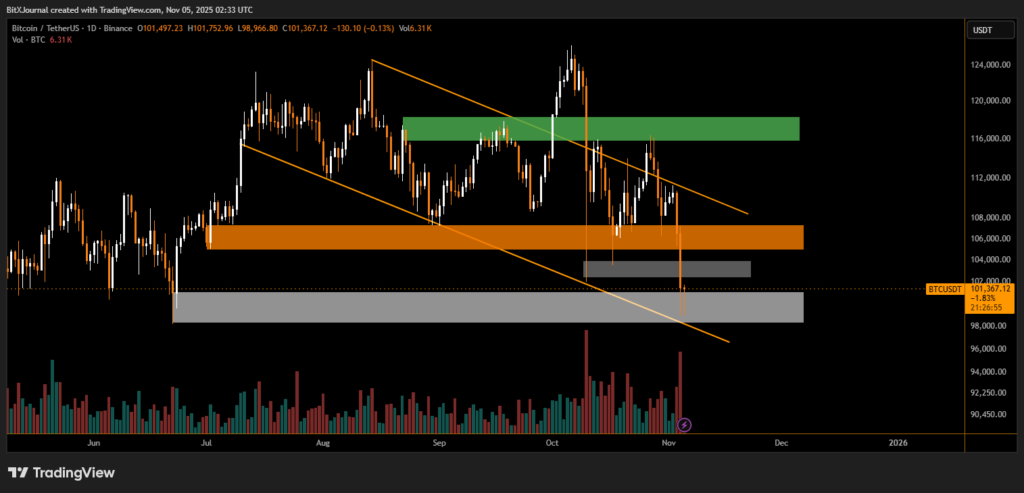

Bitcoin fell to four-month lows near $100,800 on Tuesday, triggering a wave of concern across the market. Analysts from Bitfinex noted that persistent selling by long-term holders continues to “exert structural pressure” on Bitcoin’s price.

“This sustained outflow aligns with broader signs of exhaustion,” they added. “If Bitcoin fails to recover above $116,000 soon, further downside remains likely.”

The Crypto Fear & Greed Index dropped sharply to 21 out of 100, signaling “Extreme Fear” among traders. Bitcoin’s price has already declined more than 10% over the past week, according to BITXjournal data.

“Unless Bitcoin reclaims its key resistance range, time becomes a growing headwind for bulls,” Bitfinex analysts warned. “Prolonged stagnation tends to erode sentiment and increase the risk of forced distribution.”

Bullish forecasts fade — for now

The renewed weakness contrasts starkly with bullish predictions made just weeks ago, when industry leaders remained confident that Bitcoin would achieve six-figure valuations before 2026.

Speaking on the Bankless podcast, Tom Lee and Arthur Hayes reiterated their view that Bitcoin could reach $200,000 to $250,000 before the end of the current cycle.

However, Mike Novogratz, CEO of Galaxy Digital, cautioned that such an outcome would require “planets to align perfectly,” hinting that market liquidity and macroeconomic headwinds could make it difficult to sustain such a move.

2026: Bull or bear? Analysts remain split

The outlook beyond 2025 remains uncertain. Bitwise CIO Matt Hougan suggested that 2026 could mark the beginning of another bullish phase, supported by institutional inflows and growing ETF participation.

In contrast, financial analyst Andrew Lokenauth argued that “2026 will likely be a bear market, similar to prior midterm years,” while veteran trader Peter Brandt warned that Bitcoin could revisit levels as low as $60,000 if sentiment fails to recover.

As Bitcoin hovers just above the $100,000 threshold, the market appears trapped between institutional accumulation and profit-taking by long-term holders — a dynamic that could define the rest of 2025’s trading environment.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.