Bitcoin Current Price Action and Support Breakdown

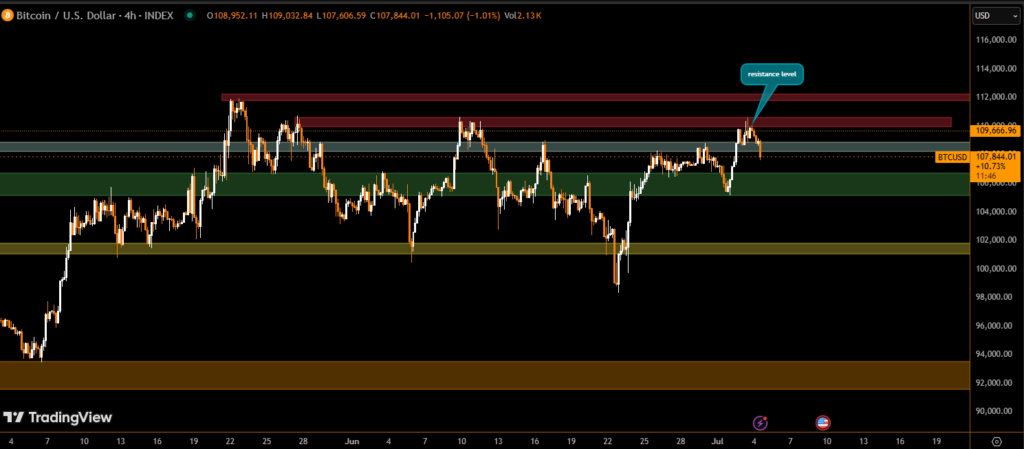

Bitcoin (BTC) is currently trading below the critical $108,000 level, hovering around $107,764, following a 1.5% intraday decline. This sharp retracement has pushed the leading cryptocurrency away from its recent highs near $110,000, signaling increasing market hesitation as macroeconomic uncertainties resurface.

The $108K level had been acting as a psychological and technical support for the past few weeks. Its breakdown suggests a potential short-term bearish shift, especially as institutional inflows slow and open interest in futures contracts sees a notable drop.

Technical Outlook: Bearish Pressure Builds

From a technical analysis standpoint, Bitcoin faced rejection at $110,000 earlier this week and failed to sustain upward momentum. Key support at $108K has now flipped into resistance, and downside targets are now being recalibrated.

- Immediate support lies at $105,600 and $103,200, levels where buyers have previously stepped in.

- The Relative Strength Index (RSI) is trending downward, hovering near neutral territory, which reflects weakening momentum.

- Volume indicators show declining buying pressure, confirming the pullback may extend further if bulls do not regain control quickly.

Intraday volatility has spiked, with price swings between $110,000 and $107,700 in less than 24 hours. Such compression below resistance typically precedes a breakout—or further breakdown.

Futures Volume Drops and Summer Slump Signals

Adding to the bearish pressure, Bitcoin futures volume dropped nearly 20% in June, recording just $1.55 trillion across major centralized exchanges. This continues a three-year trend of reduced trading activity during summer, often referred to as the “crypto summer slump.”

A decline in open interest and capital rotation toward altcoins also signals reduced conviction among traders in the short term. If the trend continues, Bitcoin may retest the $100,000–$102,000 demand zone before attempting another breakout.

Outlook: Will Bitcoin Reclaim Momentum?

Despite the short-term weakness, macro tailwinds like rising U.S. debt, expanding money supply, and institutional ETF flows continue to support Bitcoin’s long-term bullish case.

However, for bullish momentum to return, Bitcoin must decisively reclaim and close above the $108,500–$110,000 zone with high volume.

Until then, traders should watch for further consolidation or even deeper corrections, especially if market confidence continues to waver.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.