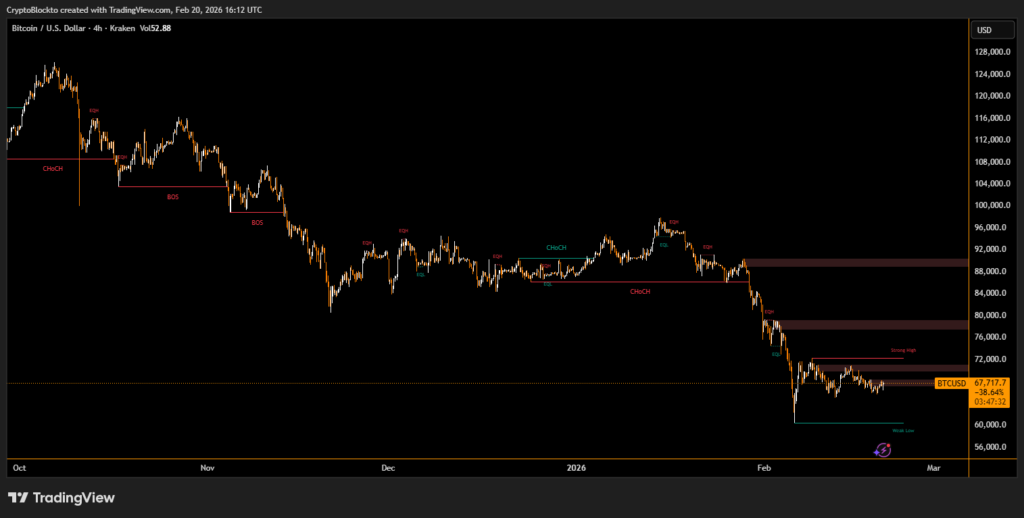

Bitcoin continues to trade below a critical onchain valuation threshold, reinforcing concerns that the market remains in a broader consolidation phase. According to recent analysis from Glassnode the asset has broken beneath its “True Market Mean,” currently near $79,000 a level that reflects the aggregate cost basis of active supply and historically separates expansionary trends from compression regimes.

With that breakdown confirmed, analysts now frame a structural range between $79,000 and the Realized Price near $54,900, which represents the average acquisition cost of all circulating coins. At roughly $67,700, Bitcoin remains lodged within this corridor, lacking the momentum required for a decisive breakout.

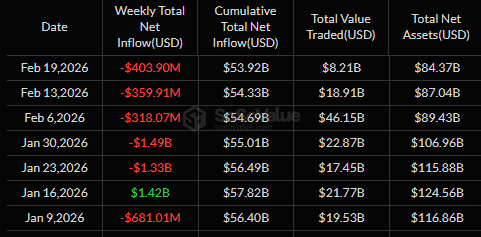

ETF Outflows and Spot Selling Pressure Persist

Institutional demand has softened notably in recent weeks. U.S. spot Bitcoin exchange traded funds have shifted back into sustained net outflows, removing a consistent source of marginal buying pressure. At the same time, cumulative spot volume delta across major exchanges has turned negative, signaling active sell side aggression rather than thin liquidity alone.

Onchain accumulation indicators show some stabilization, but conviction among large holders remains limited. The Accumulation Trend Score has moved closer to neutral territory, suggesting distribution has eased without a strong return of aggressive buying.

Derivatives Data Reflects Cooling Panic, Not Renewed Optimism

Options markets indicate that the acute phase of panic hedging has subsided. Implied volatility has declined from recent highs, and downside skew has compressed. However, traders have yet to meaningfully rebuild bullish exposure.

Analysts broadly agree that a sustained recovery will likely require improved liquidity conditions, renewed ETF inflows, or a clearer macroeconomic pivot before conviction returns to the market.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.