Analysts Say BTC Whales’ Options Strategy Is Capping Upside Despite ETF Demand

Bitcoin’s struggle to break higher levels may be less about weak demand and more about selling pressure from long-term holders using options strategies. Market analysts argue that Bitcoin OGs selling covered calls are a primary factor suppressing spot prices, even as traditional investors show strong appetite through exchange-traded funds.

Covered calls involve selling call options against existing Bitcoin holdings to collect premiums. According to analysts, large and long-term BTC holders often referred to as whales are deploying this strategy at scale. While profitable for the sellers, this activity introduces persistent sell-side pressure into the market.

When market makers buy these call options, they must hedge their exposure by selling spot Bitcoin, which directly pushes prices lower. This dynamic occurs regardless of strong inflows from Bitcoin ETFs, effectively neutralizing bullish momentum.

The Bitcoin used to back these options has often been held for a decade or longer, meaning it does not represent new demand or fresh liquidity. As a result call selling becomes a net negative “delta” event adding downside pressure without corresponding buying interest.

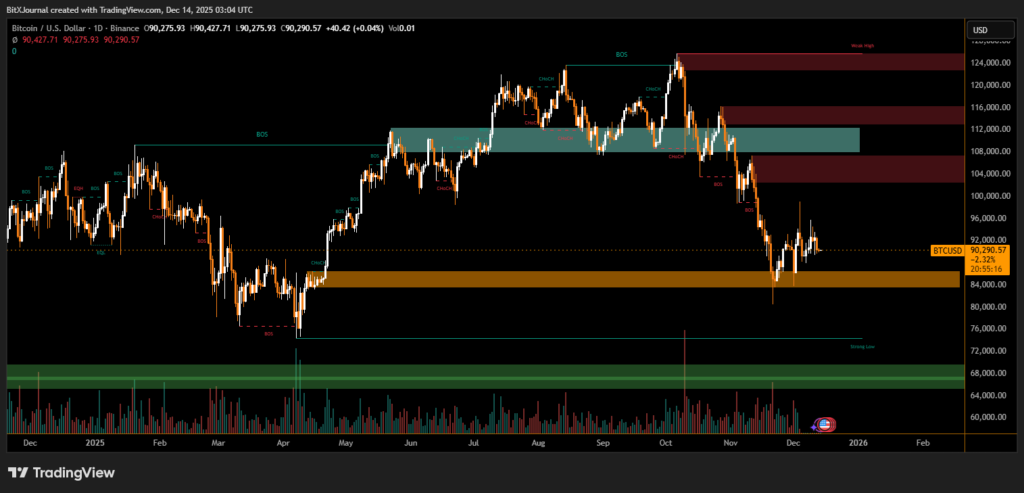

Analysts conclude that Bitcoin’s short-term price behavior is increasingly dictated by the options market, not spot demand alone. As long as whales continue monetizing their holdings through covered calls, price action is likely to remain choppy and range-bound.

Some analysts expect renewed upside if Federal Reserve rate cuts inject fresh liquidity into markets. However, others warn that continued options-driven selling could still drag Bitcoin lower before any sustained rally resumes.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.