Bitcoin (BTC) continues to trade near record highs, with the price action reflecting growing institutional confidence and favorable macroeconomic signals. As of July 10, Bitcoin reached an intraday peak of $112,163, supported by strong momentum and technical breakout signals.

Bitcoin Price Nears All-Time High Resistance

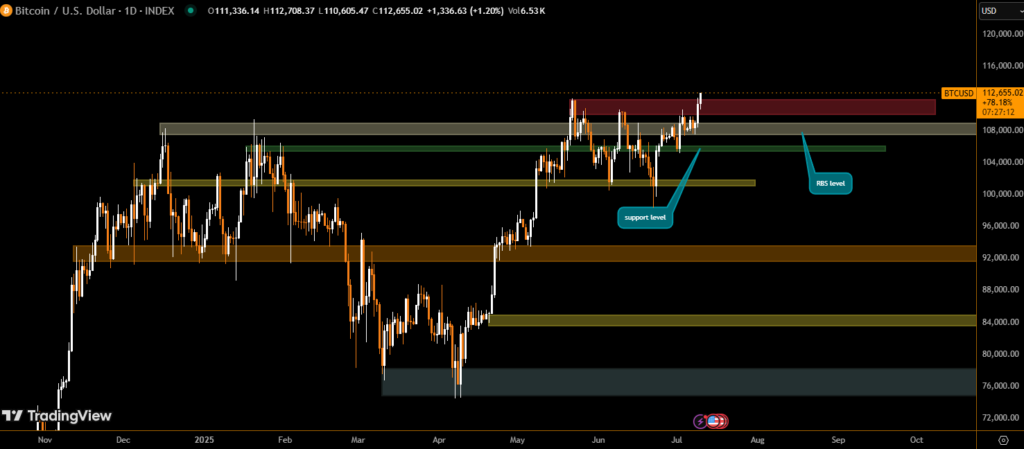

The recent move above $110,000 marks a critical milestone in Bitcoin’s market structure. After a brief pullback from earlier highs, BTC is attempting to confirm support near $111,000–$112,000, a zone that now serves as both a technical and psychological resistance level.

Price volatility remains moderate, with support at $107,000 and next key resistance projected near $114,900 to $120,000. A confirmed breakout above this band could trigger further upside toward the $140,000 price target identified by technical analysts.

Bitcoin Technical Analysis Shows Bullish Momentum

Bitcoin’s chart structure reveals a clean breakout from a descending channel, often viewed as a bullish continuation pattern. The Relative Strength Index (RSI) remains in a healthy zone, suggesting that BTC is not yet overbought, leaving room for further gains.

The 50-day and 100-day moving averages continue to slope upward, signaling strong bullish trend confirmation. Traders are watching for sustained price action above $112,000, as this could validate the next leg of the rally.

Institutional Accumulation and ETF Flows Support Bitcoin Price

On-chain metrics and exchange data show a continued decline in BTC reserves on spot trading platforms. This shift is attributed to growing institutional accumulation, particularly via Bitcoin exchange-traded funds (ETFs) and custodial wallets.

Several analysts note that lower exchange supply combined with rising demand has created favorable conditions for upward price pressure. The volume backing recent price moves also shows strength, with daily trading volumes rising sharply over the past 48 hours.

Macroeconomic Factors Fueling Bullish Outlook

Expectations of a potential U.S. interest rate cut later this year, along with a weakening U.S. dollar index, are adding fuel to Bitcoin’s rise. These macro tailwinds enhance Bitcoin’s appeal as a store of value and inflation hedge, especially for long-term holders.

If current trends hold, Bitcoin may establish a new base above $110,000, positioning itself for a breakout toward fresh all-time highs in the coming weeks.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.