BTC Consolidates Below Resistance as Traders Eye Key Support at $105K–$106K Zone

After a strong surge past $110,000 earlier this week, Bitcoin (BTC) has entered a mild retracement phase, pulling back toward $107,000 as traders lock in profits and markets digest the recent rally. Despite the pullback, analysts view the correction as a healthy consolidation within an ongoing uptrend, suggesting that the leading cryptocurrency could be preparing for another move higher if support levels hold.

Bitcoin Technical Analysis: Support Holds Above $105K

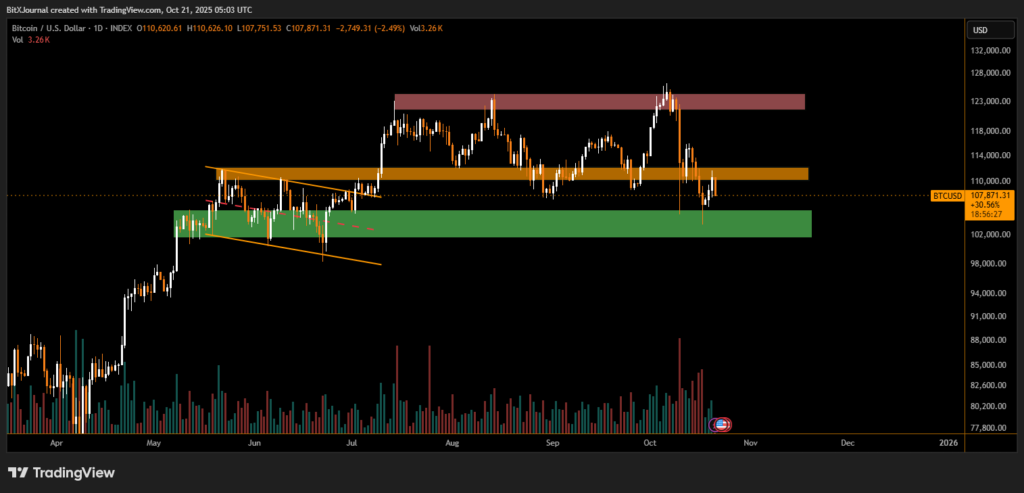

The daily chart shows that BTC is currently testing support near the $105,000–$106,000 range, an area that previously acted as a strong demand zone in late September. This level also aligns with the green support band highlighted on the chart, suggesting potential buying interest among long-term holders.

Above current levels, the first major resistance lies between $112,000 and $115,000, where multiple rejections have occurred in recent weeks. A decisive breakout above this zone could open the path toward $123,000, which remains the upper resistance area of the ongoing trading range.

“This pullback is typical following a parabolic leg; Bitcoin often retraces around 2–3% before resuming its upward momentum,” noted BITX market strategist. “As long as BTC remains above $105,000, the broader bullish structure is intact.”

The retracement coincides with broader market caution amid renewed U.S.–China tariff tensions and investor repositioning following Bitcoin’s early October all-time high near $128,000. Meanwhile, optimism surrounding spot ETF approvals and continued institutional inflows remain key catalysts underpinning long-term sentiment.

Experts argue that short-term volatility is part of a healthy market cycle, especially after Bitcoin’s extended rally earlier this month. “This type of correction often clears leveraged positions and provides stronger footing for sustainable growth,” According to BITX digital asset researcher.

If Bitcoin maintains stability above $105,000, traders expect a rebound toward $112,000, potentially setting up a retest of the higher resistance range near $120,000. However, a breakdown below $104,000 could open the door to deeper retracement toward the $98,000 zone, where stronger demand awaits.

For now, BTC’s retrace to $107K appears to be a short-term pause rather than a reversal, with technical structure and market fundamentals still favoring the bulls heading into late October.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.