After failing to maintain momentum above $115K, Bitcoin faces renewed selling pressure, testing a critical support region that could determine the next market trend.

Bitcoin (BTC) has entered a retracement phase, falling back to around $112,500 after a brief attempt to hold above $115,000. The leading cryptocurrency is now testing a crucial support zone between $111,000 and $113,000, a level that has historically acted as a strong base for bullish rebounds. Traders and analysts are closely watching whether BTC can hold this region — or if further downside pressure could trigger a deeper correction.

Bitcoin Technical Analysis

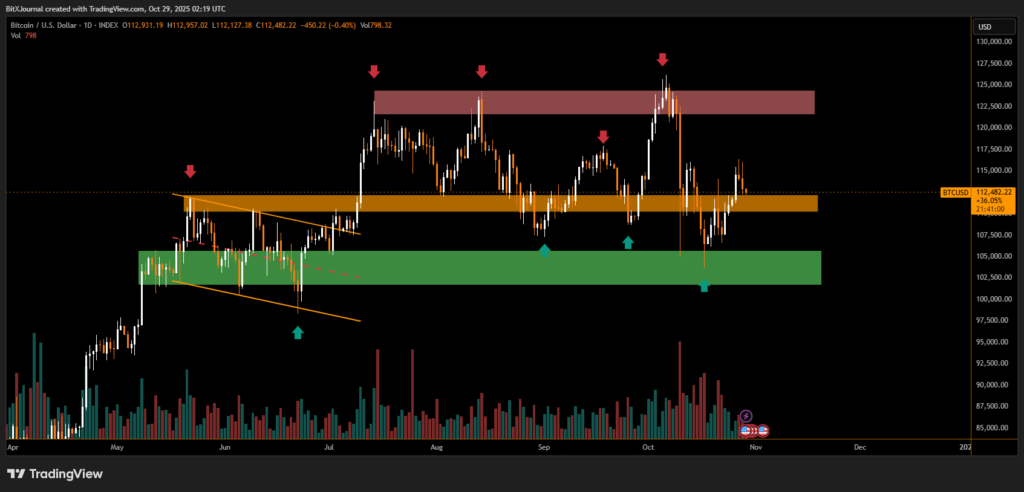

The daily chart shows BTC consolidating within a broad trading range, with resistance forming near $124,000 and support anchored around $105,000–$107,000. The recent price action suggests that Bitcoin’s uptrend momentum has paused, with sellers stepping in near the upper resistance band marked by repeated rejections.

The chart also highlights multiple supply and demand zones, represented by red and green regions. The upper red zone around $122,000–$125,000 continues to cap upside moves, while the lower green zone around $103,000–$106,000 remains the strongest area of buying interest.

BitXJournal crypto market strategist commented, “Bitcoin’s short-term weakness doesn’t change the broader trend yet, but holding above $111K is critical. A breakdown below that could invite a retest of $107K, while a strong rebound may push BTC back toward the $118K–$120K region.”

Trading volume has moderated, indicating that traders are cautious amid mixed macroeconomic signals and ETF-driven speculation. Despite short-term volatility, on-chain data shows accumulation near current levels, suggesting long-term investors remain confident.

BitXJournal analyst noted, “The $110K–$113K range is a liquidity pocket where institutions may look to reload. As long as BTC stays above $107K, the bullish structure remains intact.

Bitcoin’s retracement to $112K marks a decisive moment for market direction. If bulls defend the current support, a rebound toward $120K could materialize in the coming sessions. However, a failure to hold may confirm a short-term correction, extending toward deeper support near $105K before any significant recovery attempt.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.