Geopolitical Jitters Shake Crypto Markets

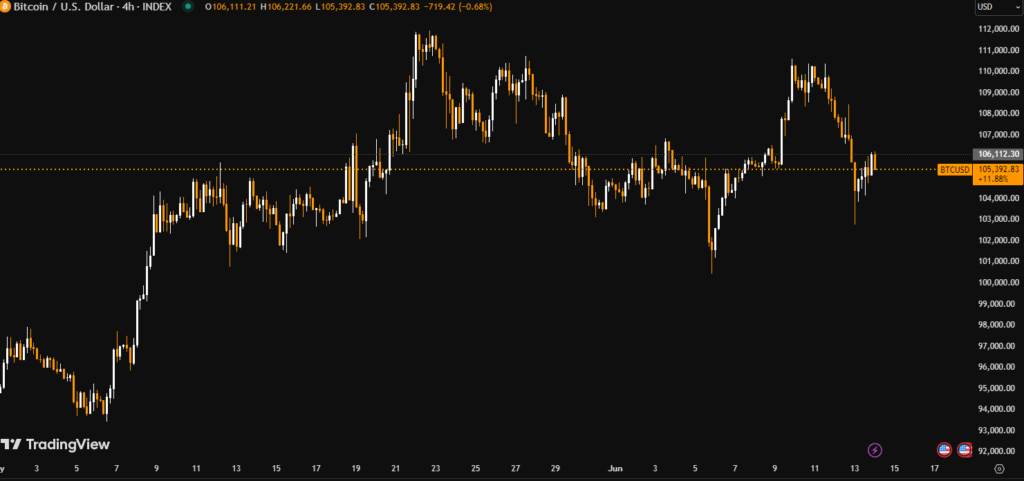

Bitcoin saw a swift recovery to around $106,000 after a sharp dip to $102,600, triggered by escalating tensions between Iran and Israel. However, despite the bounce, BTC remains over 6% below its all-time high, suggesting ongoing market caution.

In the past 24 hours, bitcoin traded near $105,200, down 1.6%, as reports of renewed airstrikes surfaced. The conflict has introduced fresh volatility into both crypto and traditional markets, with investors closely monitoring developments through the weekend.

Altcoins and Crypto Stocks React Sharply

The broader crypto sector mirrored bitcoin’s movements. The top 20 cryptocurrencies by market cap, excluding memecoins and stablecoins, fell 4.4%. Major tokens like ether, avalanche, and toncoin plunged between 6% to 8%, showing the risk-off sentiment spreading across the space.

While crypto mining stocks struggled — with MARA Holdings and Riot Platforms falling 5% and 4% respectively — one standout was Circle, a stablecoin issuer. Its stock surged 13% following its IPO and reports of Amazon and Walmart considering stablecoin integrations into their U.S. operations.

The interest from major retailers signals a possible shift toward stablecoin adoption in mainstream commerce.

Traditional Markets Hold Steady

Unlike crypto, traditional markets remained relatively calm. Gold rose 1.3%, reflecting investor flight to safety. The S&P 500 and Nasdaq only dipped 0.4%, suggesting the broader market is not yet pricing in major geopolitical fallout.

Analysts Warn of Further Downside Risk

Analysts caution against celebrating the bounce too early. One technical analyst flagged the move below $106,000 as a failed breakout, signaling that a deeper correction could be underway.

Key support lies between $100,000–$101,000. A break below this range may result in renewed consolidation, similar to the mid-2024 price action.

A potential drop to the $88,000–$93,000 zone is on the table, according to market experts, who view $90,000 as a favorable entry point for long-term investors.

Still, the long-term outlook remains bullish. If support holds, the next leg higher could drive BTC toward the $130,000 level in the coming months.

Summary

Bitcoin’s bounce to $106K amid Iran-Israel tensions highlights its volatility. While short-term pressure persists, long-term investors eye $90K as a strategic re-entry before targeting $130K highs.