Bitcoin (BTC) surged to $108,000 on June 9, driven by renewed market optimism, strong equity forecasts, and a massive leveraged bet by a high-profile crypto whale. The bold move signals rising confidence in a potential breakout toward Bitcoin’s all-time high.

Whale Wallet Places $54.5M 20x Long Bet at $106,538

A newly created wallet, “0x1f25,” funded with $10 million in USDC, entered a high-stakes trade on decentralized exchange Hyperliquid. The trader opened a 511.5 BTC long position at an average entry of $106,538, using 20x leverage with a liquidation level at $88,141.

The position is currently in profit by over $11,000, signaling strong timing and execution during a high-momentum phase.

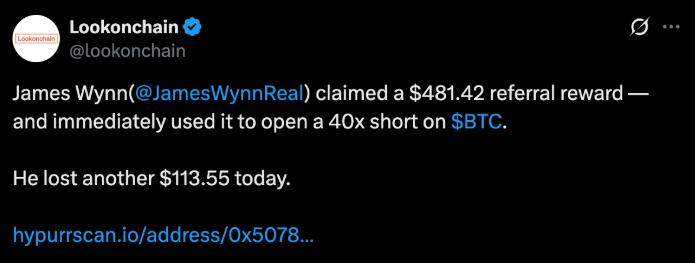

James Wynn Suspected Behind Aggressive Whale Trade

Crypto observers speculate the wallet may belong to James Wynn, a well-known trader who previously faced liquidations totaling $124.3 million across several BTC positions in late May and early June. Wynn is known for his aggressive leverage trading style, matching the behavior of wallet “0x1f25.”

Despite prior losses, the trader has re-entered with conviction, a sign of renewed bullish expectations.

US-China Trade Talks Fuel Market Optimism

The rally coincided with ongoing trade negotiations between the US and China in London. Early reports suggest progress on easing tech export restrictions in return for greater access to rare earth materials, which could improve global market conditions.

Both Bitcoin and US equities responded positively, reflecting risk-on sentiment among investors.

Strategists at JPMorgan and Citigroup revised upward their year-end targets for the S&P 500, while other firms forecast stronger economic growth—factors that have boosted investor confidence across asset classes, including crypto.

Analysts Expect BTC to Break All-Time High Soon

According to analyst Ted Pillows, Bitcoin is tracking a similar breakout pattern seen in recent rallies of gold and the S&P 500. If the trend holds, BTC may break its record high of $110,000 within 1–2 weeks.

The current consolidation above $107K is viewed as a bullish structure, forming the base for a possible explosive move.

Whale Could Gain $22.5M If Bitcoin Hits $150K

Should Bitcoin reach $150,000 by year-end, as some analysts predict, the whale’s position could yield a 225% return—translating to approximately $22.5 million profit from the original $10 million margin.

Conclusion

Bitcoin’s rebound to $108K marks a significant moment in the current market cycle. A $54.5M leveraged bet by a crypto whale, alongside positive macro developments, has reignited bullish sentiment. With analysts forecasting a new all-time high within weeks, all eyes are on BTC’s next move.