Bitcoin has closed four consecutive months in negative territory for the first time since 2018, extending its recent downturn as global markets undergo a broad reassessment of liquidity and monetary policy expectations. The move has unfolded alongside synchronized sell-offs in equities and precious metals, signaling a wider risk reset rather than crypto-specific weakness.

Bitcoin Price Decline Reflects Macro Repricing

Bitcoin slipped below the $78,000 level, with prices briefly dipping near $74,500 during the latest sell-off. The decline has been accompanied by heavy institutional withdrawals, with global crypto investment products posting roughly $1.7 billion in weekly outflows, following significant redemptions from spot Bitcoin exchange-traded products throughout January.

January also marked Bitcoin’s weakest start to a year since 2022, reinforcing the depth of the current correction.

Liquidity Reset Hits Stocks and Gold

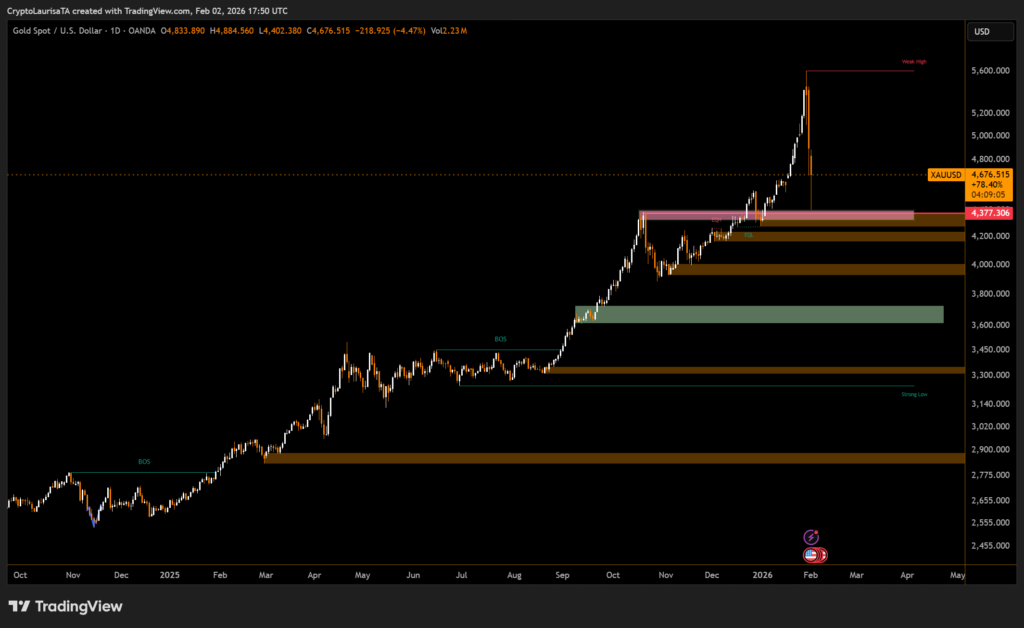

Analysts point to a decisive shift in macro conditions, driven by tighter financial expectations and renewed concerns over US dollar liquidity. Gold fell nearly 7% from recent highs, while silver experienced sharp drawdowns as leveraged positions were unwound across futures markets.

This cross-asset pullback suggests investors are reducing exposure to macro-sensitive assets as a group, rather than rotating into traditional safe havens.

Futures markets have seen a steep drop in open interest, alongside one of the largest long liquidation waves in recent months. Onchain data shows Bitcoin trading below short-term cost bases, placing recent buyers under pressure, while miner flows to exchanges have added to near-term selling.

Despite the stress, some analysts see conditions forming for a medium-term bottom later in 2026, once forced selling subsides and liquidity conditions stabilize.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.