Bitcoin (BTC) climbed to $108,337, gaining 0.54% in 24 hours, as investor sentiment turned bullish following former President Donald Trump’s comments on the U.S. fiscal outlook. Analysts say Trump’s remarks about prioritizing growth over deficit concerns could fuel long-term demand for Bitcoin and gold, especially as trust in fiat stability weakens.

Trump’s Comments Highlight Deficit Risks, Fueling BTC Optimism

On June 29, 2025, Trump took to Truth Social, urging fellow Republicans to back his sweeping fiscal legislation, stating:

“We will make it all up, times 10, with GROWTH, more than ever before.”

The comment sparked market reaction, reinforcing the bullish case for Bitcoin and other hard assets. Trump’s stance suggests ongoing deficit spending to support tax cuts and defense funding — a policy direction seen by many as inflationary.

Crypto analyst Will Clemente summed it up: “How can you read this and not hold Bitcoin or gold?”

His remarks reflect growing concern that long-term U.S. Treasuries may become less attractive in an environment where government debt expands unchecked, making Bitcoin a preferred store of value.

Details of Trump’s Fiscal Proposal Add to Inflationary Fears

The proposed “One Big Beautiful Bill” spans over 900 pages, combining:

- $3.8 trillion in tax cuts

- Elimination of taxes on tips, overtime pay, and auto loans

- Expanded child tax credit and senior deductions

- Funding increases for defense and border security

To balance these cuts, Republicans propose reductions to Medicaid and nutrition programs, sparking internal GOP divisions and criticism from Democrats.

If passed, analysts project the plan could add trillions to the current $36.2 trillion national debt.

Such projections raise the appeal of hard assets like Bitcoin and gold as inflation hedges, especially with growing uncertainty over fiscal discipline.

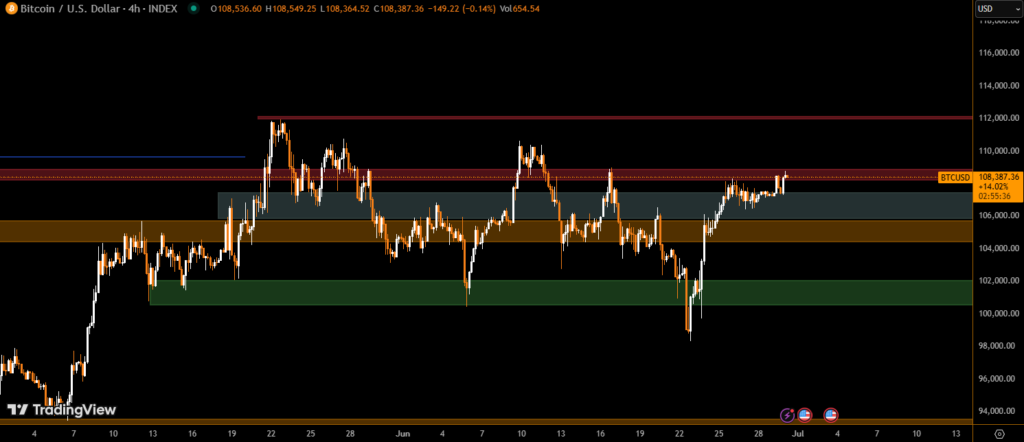

Bitcoin Technical Analysis: Rebound Holds Above Key Support

From June 28 to June 29, BTC:

- Traded between $107,194 and $108,489

- Found support at $107,300, rebounding multiple times

- Volume spiked at 7,538 BTC during bullish momentum

- Formed a descending channel, then rebounded near $108K by the end of day

Fiscal Policy Tensions Reinforce Bitcoin’s Value Proposition

As government debt rises and debates over fiscal responsibility continue, Bitcoin’s scarcity, decentralization, and resistance to inflation make it increasingly attractive. Trump’s remarks may further solidify BTC’s position as a hedge against political and economic instability heading into 2025.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.