On-chain analytics firm says weakening demand and bearish sentiment could push Bitcoin down 28% within two months if buyers fail to defend the six-figure level.

Bitcoin Faces Crucial Support Test at $100K

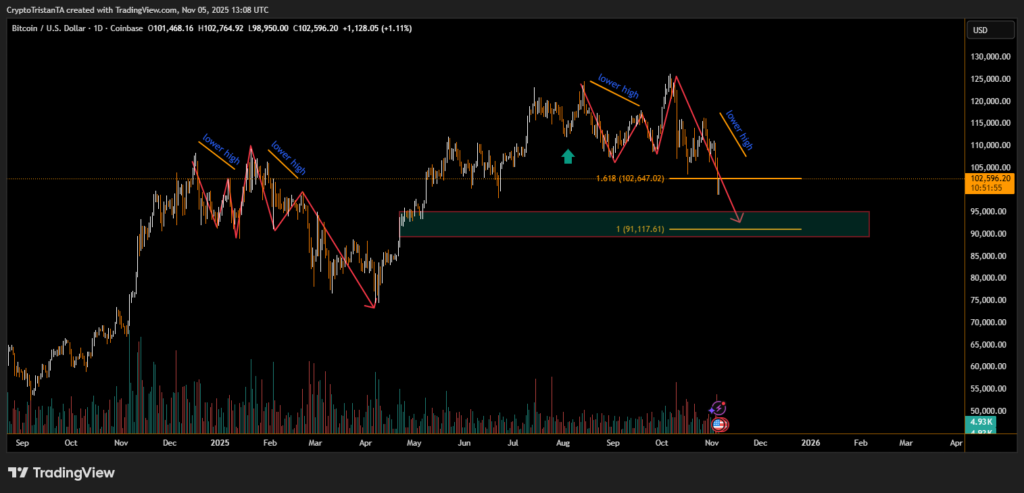

Bitcoin could fall to around $72,000 within the next one to two months if it fails to hold the $100,000 support level, according to new analysis from on-chain intelligence firm CryptoQuant.

“If the price doesn’t manage to hold the ~$100,000 area and breaks downwards, there are higher risks of targeting $72,000 in a one- to two-month period,” said Julio Moreno, head of research at CryptoQuant.

Bitcoin briefly dropped below $100,000 on Tuesday — its first dip under the threshold since June — before recovering slightly to trade near $100,800. The move represents a 5.2% decline in 24 hours, accompanied by a 9% slide in the broader GMCI 30 crypto index, reflecting widespread weakness across digital assets.

Demand Weakens After Record $20B Liquidation

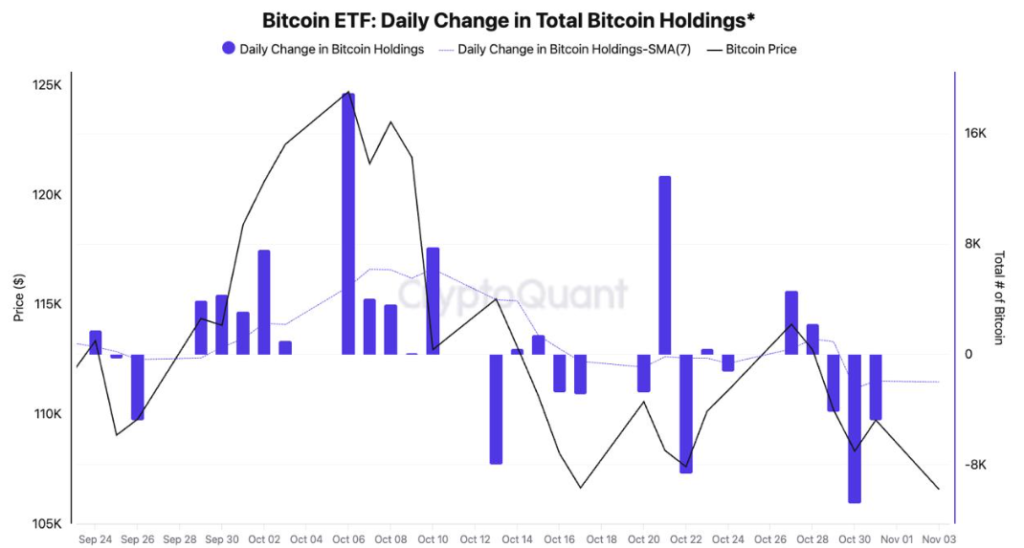

CryptoQuant attributed the market’s deterioration to declining demand following the Oct. 10 record liquidation event, which erased more than $20 billion in leveraged positions — the largest single wipeout in crypto history.

“Since then, spot demand for Bitcoin has been contracting,” Moreno said. “In the U.S., investors have also lowered their exposure, as shown by negative ETF flows and a negative Coinbase price premium.”

The firm’s proprietary Bull Score Index — which measures market sentiment — currently stands at 20, signaling deep bearish conditions.

Macro Headwinds Add Pressure

Broader macroeconomic concerns are compounding the bearish momentum.

Gerry O’Shea, head of global market insights at Hashdex, said the crypto selloff reflects a wider risk-off mood driven by tightening financial conditions.

“Speculation that the FOMC may skip another rate cut, along with worries over tariffs, credit markets, and stretched equity valuations, has dragged markets lower,” O’Shea explained.

He added that recent selling from long-term Bitcoin holders is an “expected phenomenon” as the asset matures and prices stabilize at higher levels.

Despite the near-term risk of further declines, O’Shea said Bitcoin’s long-term investment case remains strong.

“ETF inflows and corporate adoption trends are resilient,” he said. “As traditional financial institutions continue building digital asset infrastructure and the Fed eventually eases liquidity conditions, Bitcoin could still reach new all-time highs in the coming months.”

For now, the $100,000 mark remains the key psychological and technical battleground — one that could determine whether Bitcoin’s next major move is a rebound or a retreat toward $72,000.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.