Bitcoin’s risk-adjusted performance has deteriorated sharply, with a key metric now hovering near levels historically associated with late-stage bear markets.

Bitcoin Sharpe Ratio Signals Extreme Risk-Reward Conditions

The Bitcoin Sharpe ratio, a measure that compares returns against volatility, has dropped to around -10, marking its weakest reading since early 2023. Negative values indicate that investors are taking on elevated risk without being adequately compensated by returns.

Historically, similar readings have appeared near major market lows. Comparable conditions were observed during the depths of the 2018–2019 downturn and again in late 2022, both periods that preceded longer-term recoveries. While this does not imply an immediate reversal, it suggests the market is entering an extreme phase of its risk-reward cycle.

What a Negative Sharpe Ratio Means for Investors

A deeply negative Sharpe ratio reflects poor recent performance relative to volatility, signaling that Bitcoin remains unattractive from a risk-adjusted standpoint. Analysts note that the ratio continues to worsen, indicating that downside pressure may not yet be exhausted.

However, such conditions often emerge near turning zones, where selling momentum gradually weakens and long-term investors begin reassessing exposure.

Price Volatility Remains Elevated

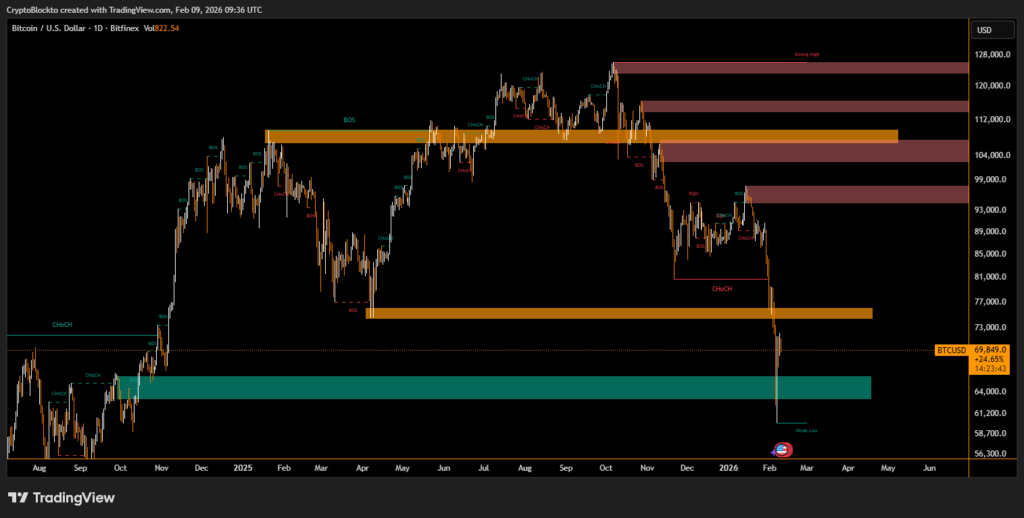

Bitcoin recently dropped toward the $60,000 level before rebounding above $70,000, though it remains significantly below its prior peak. Market observers caution that this phase could persist for months, with further corrections possible before a durable trend reversal takes hold.

For now, the Sharpe ratio suggests Bitcoin is approaching historically significant territory, but patience may still be required.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.