Market indicators point to easing selling pressure and improving consolidation conditions after weeks of volatility

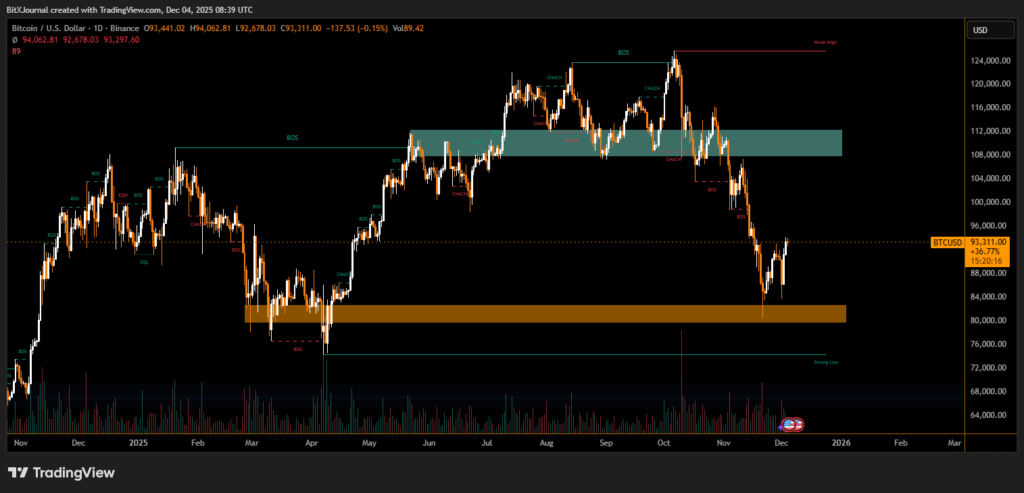

After a sharp rebound midweek, Bitcoin is showing early signals of stabilizing, prompting several analysts to suggest that a short-term recovery could be underway. The move follows an extended period of intense selling pressure, leverage unwinding and heightened market volatility.

Analysts See Conditions for a Bounce

Market researchers noted that a combination of extreme deleveraging, short-term holder capitulation and fading sell pressure has allowed Bitcoin to enter what they describe as a potential “stabilization phase.

The recent shakeout eliminated roughly $19 billion in leveraged positions, a correction many traders say cleared out excessive risk and pushed Bitcoin to its late-November low near $82,000.

The pullback and swift rebound have revived debate over whether Bitcoin’s traditional four-year cycle still applies. Historically, December has delivered muted returns, yet this year’s market behavior has already broken from long-term seasonal averages.

Several analysts argue the current environment represents a structural shift. One researcher stressed that “this cycle is not behaving like previous ones,” pointing to weakening historical correlations and new market drivers. Others maintain that Bitcoin remains “closer to a bottom than a top,” citing long-term holder accumulation and improving macro conditions.

Despite uncertainty, bullish sentiment persists among some market veterans. One well-known market chair recently reiterated confidence that Bitcoin could retest the $100,000 level before year-end if momentum strengthens.

As liquidity normalizes and sellers show signs of exhaustion, analysts say the coming weeks may determine whether Bitcoin’s latest rebound evolves into a broader recovery or simply a temporary bounce.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.