After weeks of volatility, Bitcoin (BTC) faces renewed selling pressure, dropping to around $101,000 as traders eye crucial support zones that could determine the next market trend.

Bitcoin prices retreated sharply this week, sliding to $101,535 amid a broader cooldown across the crypto market. The move marks a 1.48% intraday decline, according to real-time market data, as investors react to profit-taking and mixed macroeconomic cues. Analysts say the current correction could set the tone for Bitcoin’s short-term trajectory, with technical indicators showing a test of critical support near the $100,000 mark.

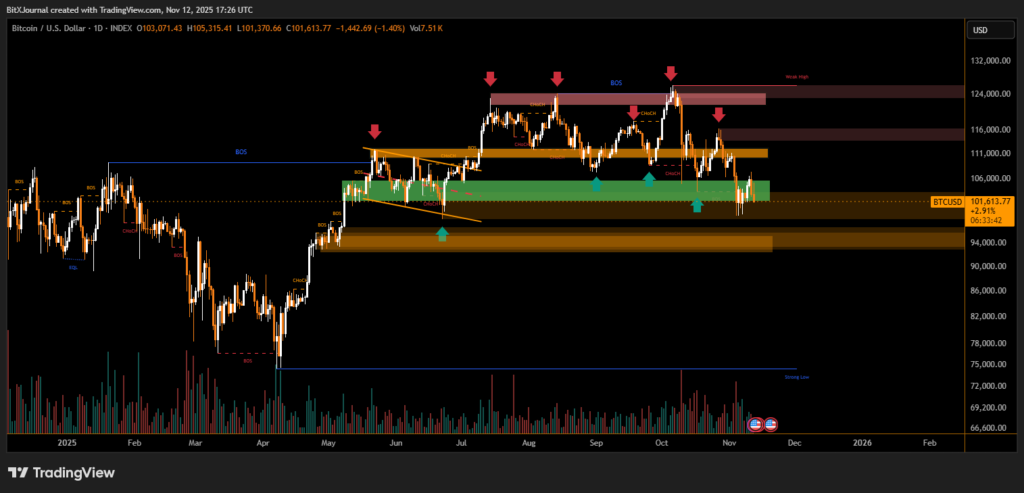

The latest technical chart patterns reveal multiple breaks of structure (BOS) and changes of character (ChoCH)—signals that often precede short-term reversals in trend direction. Bitcoin’s failure to sustain above the $116,000 resistance zone earlier this month triggered a wave of selling, pushing the asset toward the green demand zone around $100,000 to $102,000, where buyers are expected to re-emerge.

“The market is in a crucial consolidation phase,” said BitXJournal crypto market strategist. “If Bitcoin holds above the $100K support, we could see a rebound back to $110K. But a clean break below might open the path toward the next liquidity pocket near $94,000.”

The chart also shows consistent lower highs, confirming ongoing pressure from short-term sellers. However, volume spikes around recent lows suggest accumulation may already be underway. This aligns with the view that large holders, or “whales,” could be positioning ahead of the next bullish leg, especially as institutional demand for digital assets remains strong.

Despite the pullback, many analysts maintain that Bitcoin’s macro structure remains bullish on the higher timeframe. A breakout above $112,000–$114,000 could invalidate the current downtrend and signal renewed momentum toward the previous peak near $124,000.

Still, the short-term sentiment remains cautious. “Market participants are reassessing risk as liquidity tightens and traders await macroeconomic clarity,” said BitXJournal analyst. “Until Bitcoin decisively breaks above resistance, volatility will likely dominate.”

With Bitcoin hovering around the $101K level, the coming days may prove pivotal for the world’s largest cryptocurrency. The $100K psychological floor now stands as a defining battleground between bulls and bears—a decisive move in either direction could shape the next major market cycle.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.