BTC Price Softens While Derivatives Positioning Signals Market Tension

Bitcoin is trading under renewed pressure as markets brace for a record $28 billion Boxing Day options expiry, a catalyst widely expected to drive short-term volatility. While price losses remain contained, underlying derivatives positioning and capital flows suggest growing caution among participants.

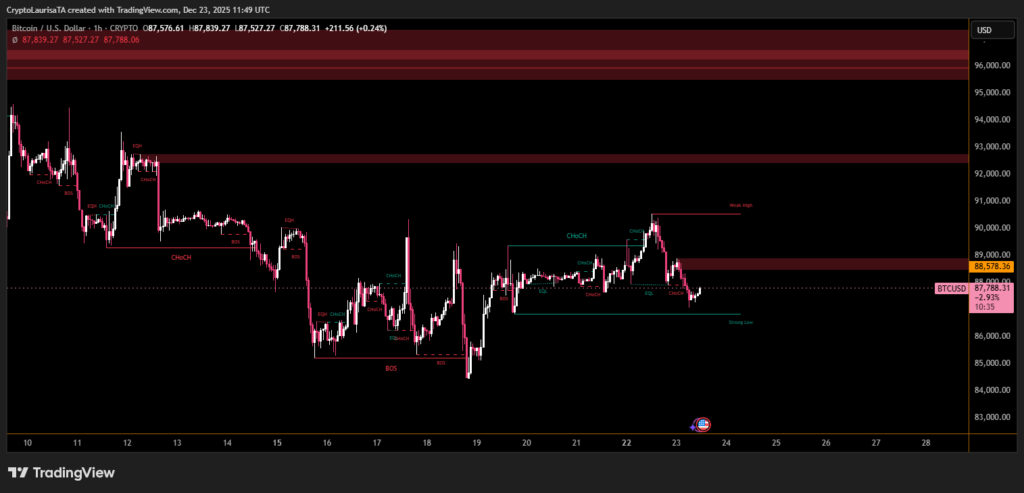

Bitcoin slipped modestly, trading near $87,800, after failing to hold recent intraday highs. The pullback reflects hesitation rather than aggressive selling, with price remaining within a broader consolidation structure. Short-term attempts to reclaim higher resistance levels were rejected, keeping BTC below key overhead supply.

Technical structure shows price rotating lower after testing a weak high, increasing sensitivity to external triggers such as derivatives expiries. Market participants appear reluctant to commit ahead of the large notional settlement.

$28B Options Expiry Becomes Central Volatility Driver

The upcoming options expiry is drawing attention due to heavy positioning around the $85,000 and $100,000 strikes. According to analysts, this structure reflects residual optimism for a late-year rally, though conviction appears limited. Large open interest near these levels increases the probability of sharp moves as hedges unwind or are rolled forward.

Adding to this dynamic, average funding rates climbed from 0.04% to 0.09%, signaling a renewed build-up of leveraged long positions. Rising leverage amid thinning order book depth can amplify price swings in either direction.

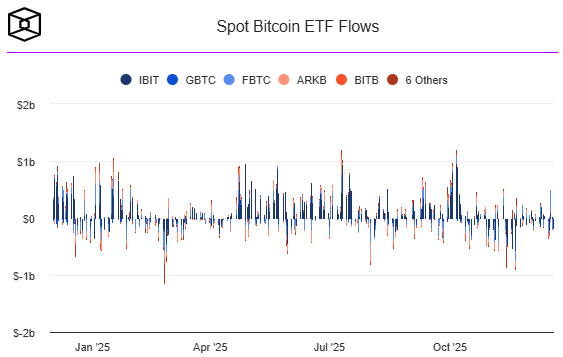

Institutional flows echoed this cautious tone. U.S. spot bitcoin ETFs recorded $142 million in outflows on Dec. 22, highlighting near-term risk reduction. In contrast, ETH products saw $84.6 million in inflows, while Solana and XRP ETFs attracted $7.47 million and $43.89 million, respectively, suggesting selective rotation rather than broad crypto exit.

With options expiry, elevated leverage, and mixed ETF flows converging, Bitcoin remains vulnerable to volatility spikes. Directional clarity is likely to emerge only after expiry-related positioning clears and spot demand reasserts itself.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.