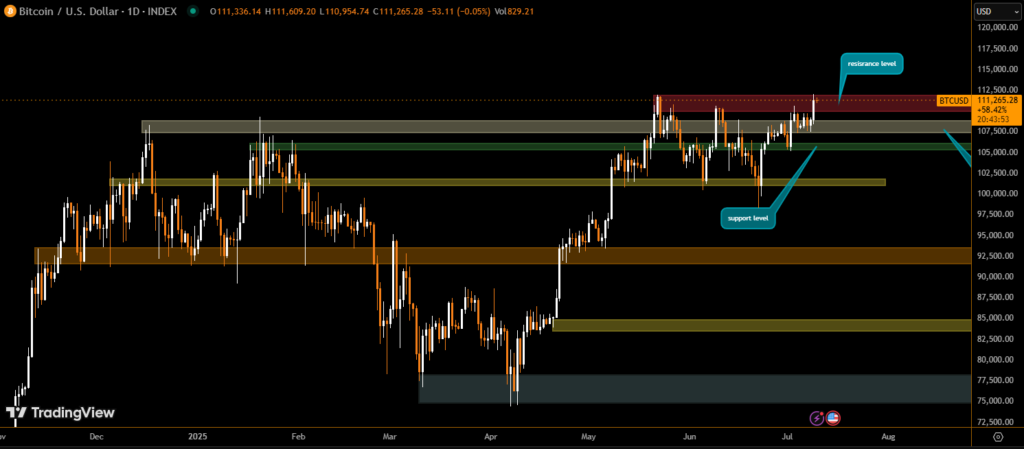

Bitcoin surged to $111,400, approaching its May record of $112,000, fueled by a sudden breakout during U.S. trading hours. After weeks of being capped near $110,000, the leading cryptocurrency broke above its recent trading range, triggering renewed optimism among traders and institutions alike.

Although some exchanges briefly recorded new all-time highs in dollar terms, aggregated price feeds still show Bitcoin just under its historical peak. The movement marks one of the most significant bullish attempts in recent weeks, signaling renewed market strength.

Ethereum Gains 6% to Hit Monthly High

While Bitcoin made headlines with its breakout, Ethereum also surged by 6%, climbing to $2,760, its highest level in nearly a month. The move reflects growing confidence in Ethereum’s long-term role in settlement infrastructure and asset tokenization.

Institutional interest in Ethereum continues to rise, with several digital asset firms naming it as one of the most “technically clean” plays for exposure to the expanding tokenization trend. ETH’s sustained strength above key support levels adds further weight to its bullish case.

Over $425 Million in Short Positions Liquidated

The rally was accompanied by a sharp correction in derivatives markets. Approximately $425 million in leveraged short positions were liquidated across the crypto market, reflecting how heavily some traders had bet against the breakout. This sudden liquidation event may have added to the buying pressure, accelerating upward momentum.

Crypto-Related Stocks Follow the Surge

The bullish momentum also extended to publicly listed crypto firms. MicroStrategy (MSTR) rose 4.4% to $414, closing in on its 2025 high. Coinbase (COIN) jumped 5%, while leading Bitcoin miners Marathon Digital Holdings (MARA) and Riot Platforms (RIOT) each climbed about 6%.

Declining Volatility Signals Potential for Bigger Move

Market analysts noted that Bitcoin’s 90-day and 360-day volatility metrics have been steadily declining, a pattern often seen before major price surges. The quiet market conditions may be setting the stage for a larger bullish breakout.

“The quiet bulls are the best,” one strategist noted, suggesting that the subdued sentiment may be the calm before a major upside move.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.