Ethereum’s Triple Bottom Signals Bullish Momentum While Bitcoin Retains Strong Support

In a strong display of market resilience, Bitcoin (BTC) surged past the $111,000 mark on Thursday, reinforcing its dominance in the digital asset market. Simultaneously, Ethereum (ETH) traded near $3,950, showing signs of a potential breakout as a triple bottom pattern emerged on its daily chart.

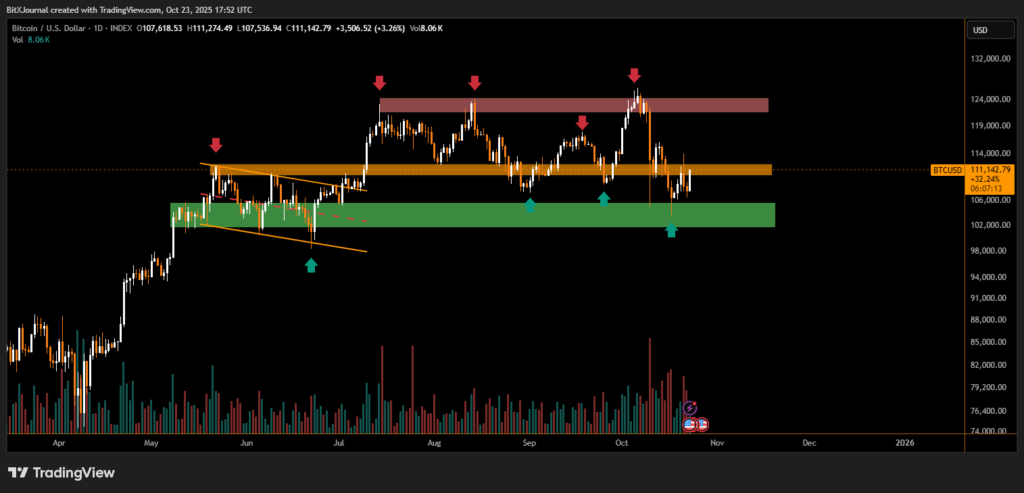

According to technical data, Bitcoin’s recent rebound from the $106,000 support zone suggests that institutional demand remains firm. The asset has repeatedly tested this level over the past months, forming a solid accumulation base that now acts as a springboard for potential gains.

“The market is entering a phase of renewed momentum,” said BITX senior crypto analyst. “As long as Bitcoin maintains above the $106,000–$107,000 range, we could see an extension toward $115,000 or even higher before year-end.”

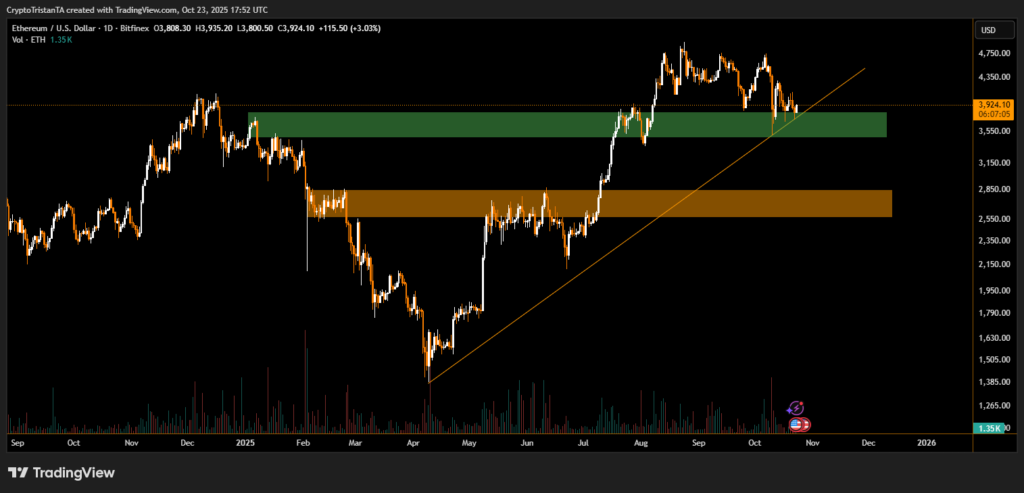

On Ethereum’s chart, a well-defined triple bottom setup indicates a potential reversal of the recent downtrend. This pattern, often associated with a shift from bearish to bullish sentiment, aligns with the broader uptrend that began in early 2025. Traders note that a clean breakout above $4,000 could confirm a new bullish leg, potentially opening the path toward $4,400.

From a technical perspective, Ethereum’s price is supported by the rising trendline and a demand zone between $3,550 and $3,700, where buyers have historically stepped in. “This area remains crucial,” According to BITX analysts. “A sustained move above $3,950 would likely attract momentum traders back into the market.”

Bitcoin’s current price behavior also reveals a tightening range near resistance around $111,500–$112,000, a level that has historically acted as both support and resistance. A decisive close above this level could mark the start of a new upward phase.

As sentiment improves across the crypto market, both Bitcoin and Ethereum appear positioned for short-term bullish continuation, with Ethereum’s technical setup signaling an imminent breakout that could lead the next rally.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.