Crypto Market Momentum Strengthens While Gold Faces a Sharp Pullback

The global financial markets witnessed a dramatic divergence this week as Bitcoin surged past $114,000, while gold prices dropped to around $4,000 and Ethereum climbed above $4,100. The movement highlights a shifting trend in investor sentiment as capital rotates from traditional safe-haven assets into digital alternatives.

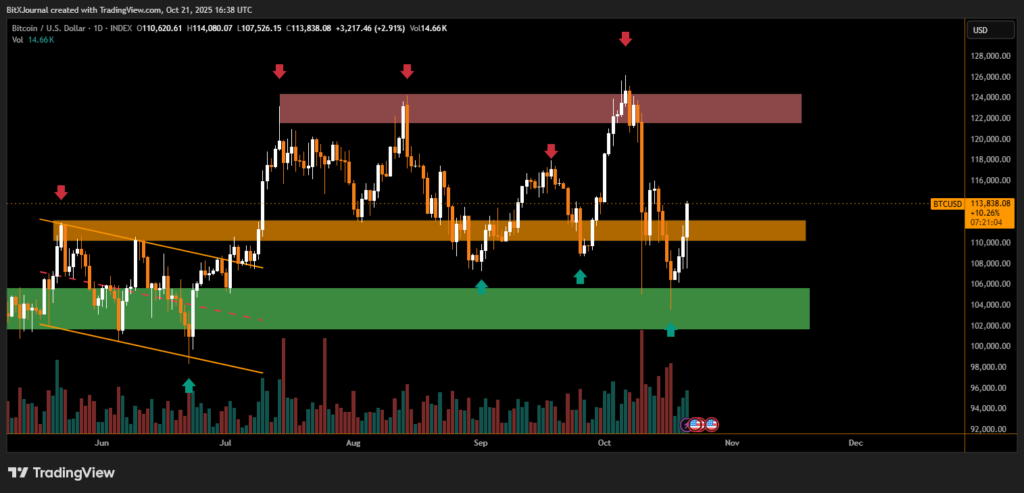

On the technical charts, Bitcoin’s strong rebound came after retesting a major demand zone near $104,000, a level that has historically acted as a key accumulation area. Analysts note that the breakout above the $110,000 resistance marks the beginning of a potential continuation phase, supported by increasing trading volumes and renewed institutional interest.

“Bitcoin’s current rally reflects renewed confidence after a healthy correction. The price is now holding above the mid-range support, signaling strength in the ongoing bull cycle,” said BITX crypto strategist.

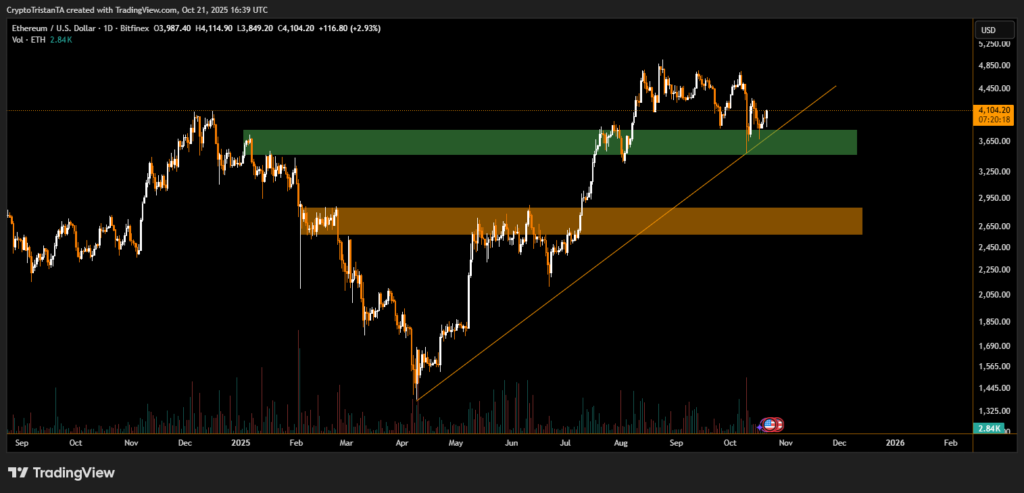

Meanwhile, Ethereum has climbed back above $4,100, maintaining a steady uptrend since early October. The move follows weeks of consolidation and aligns with bullish momentum across major altcoins. The breakout above the $3,900–$4,000 resistance zone has opened the door for potential retests of the $4,500 region, according to traders monitoring the daily trend.

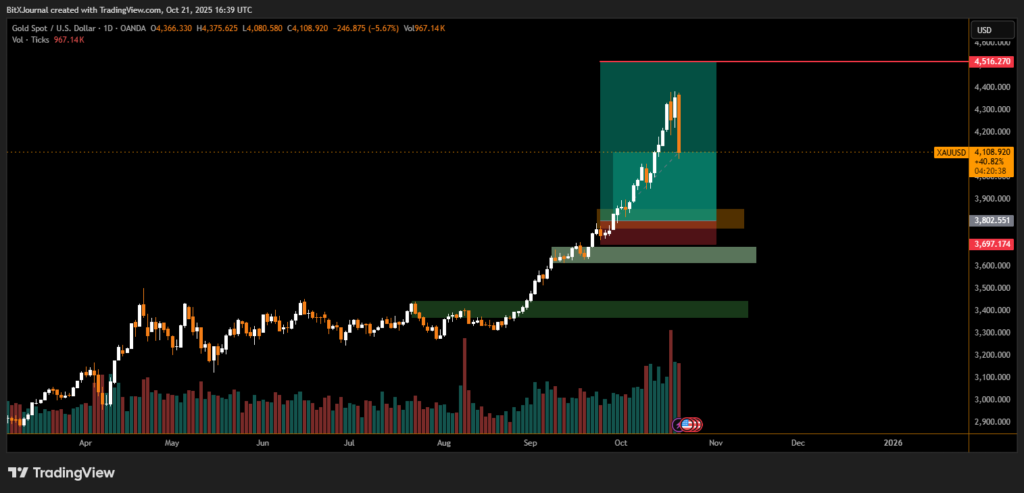

In contrast, gold faced a steep 5% decline, slipping from highs above $4,350 to the $4,100 zone, with profit-taking pressure mounting after an extended multi-week rally. Technical indicators suggest that gold is nearing short-term support, but a further dip toward $3,800 cannot be ruled out if selling continues.

Market observers emphasize that the inverse correlation between gold and Bitcoin has intensified. “As digital assets gain traction as an inflation hedge, investors are increasingly diversifying away from metals toward crypto exposure,”According to BITX commodities analyst.

The coming sessions will be crucial as traders watch whether Bitcoin can sustain its momentum above $114,000 and if gold can stabilize around key support levels before the next macro move.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.