Bitcoin (BTC) witnessed a sharp upward move on July 9, rallying toward the $110,000 mark within minutes of former U.S. President Donald Trump calling for a dramatic 300 basis point cut to the federal funds rate. The comments, shared via Truth Social, sent ripples across financial markets, triggering speculation about renewed monetary easing.

Trump’s Bold Rate-Cut Statement Triggers Immediate Market Response

At exactly 10:00 a.m. ET, Trump posted that the current U.S. Federal Reserve interest rate is “at least 3 points too high.” He argued that the elevated rate structure is costing Americans $360 billion annually in unnecessary refinancing expenses. The post quickly gained traction, and within 30 minutes, Bitcoin began climbing steadily.

By early afternoon, BTC had surged to $109,343, registering a 0.8% gain in 24 hours. Market participants interpreted the statement as a potential shift toward liquidity-friendly conditions, fueling a risk-on rally in digital assets.

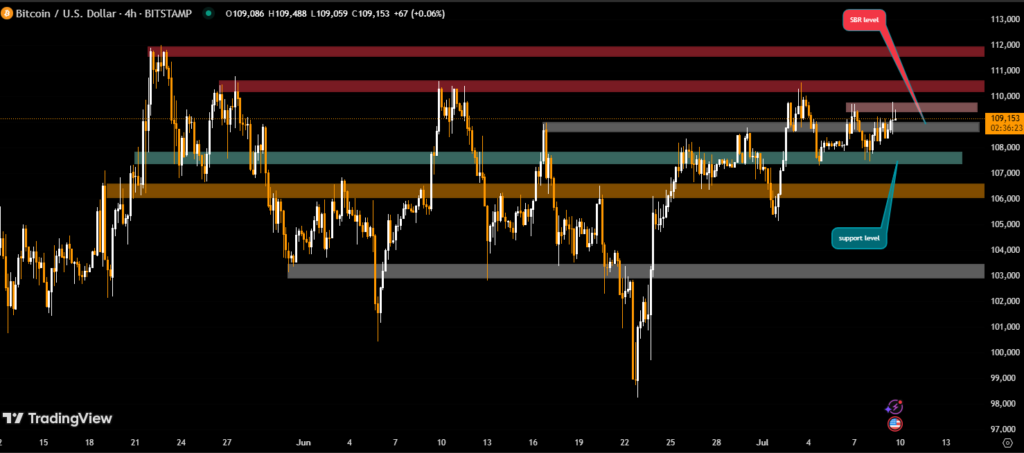

BTC TA BY BITX

Analysts Weigh In: What Would a 300 Basis Point Cut Mean?

According to macroeconomic analysis from The Kobeissi Letter, a full 3% rate cut would be unprecedented in modern U.S. monetary history. Even during the 2008 global financial crisis and March 2020 COVID crash, the Fed never implemented a cut larger than 100 basis points in a single move.

Key Estimates from The Kobeissi Letter:

- U.S. annual interest payments are now over $1.2 trillion, or $3.3 billion per day.

- A 3% cut could save $2.5 trillion over five years if 20% of national debt is refinanced annually.

- Immediate consequences could include:

- Inflation jumping back above 5%

- Gold prices rising to $5,000

- S&P 500 reaching 7,000

- U.S. dollar declining by over 10%

- U.S. home prices spiking 25% from mortgage rate drops

The report emphasized that while the short-term market rally might be strong, the long-term risks—such as currency debasement and runaway inflation—are considerable unless government spending is reduced in parallel.

Bitcoin’s Bullish Structure and Technical Signals

Bitcoin’s latest price movement aligns with technical breakout conditions, which had been building over the past week.

Technical Highlights:

- BTC tested resistance at $109,761, with higher lows forming around $108,500.

- Bollinger Bands are at their tightest since this cycle began — often a precursor to volatility.

- Institutional buyers are visibly accumulating between $108,500–$108,600, per volume cluster data.

- Trading volume spiked immediately after Trump’s post, confirming speculative capital inflows.

This setup suggests Bitcoin is entering a bullish consolidation breakout, potentially eyeing new all-time highs if macro catalysts align.

Why Bitcoin Could Benefit from Looser Monetary Policy

For Bitcoin, any signs of aggressive rate cuts are broadly seen as bullish. As a scarce digital asset often viewed as an inflation hedge, BTC typically benefits when real interest rates fall or liquidity conditions ease.

“A sudden drop in interest rates would be viewed as monetary stimulus, likely accelerating capital inflows into hard assets and alternative stores of value like BTC.”

Traders appear to be positioning for upside risk, anticipating that Trump’s influence on fiscal sentiment — even without formal policy power — may pressure the Fed or shift expectations ahead of the 2025 election cycle.

Final Thoughts: Momentum Builds, but Volatility Lurks

While the idea of a 300 bps cut remains hypothetical for now, its mere mention by a prominent political figure has sparked real market moves. Bitcoin’s strong reaction underscores how sensitive crypto assets are to macro signals, especially those tied to monetary easing.

As BTC approaches the psychological $110,000 level, investors should monitor:

- Official Fed statements and inflation data

- Further commentary from major political figures

- Institutional buying zones and volume profiles

With technical and fundamental momentum aligning, Bitcoin may be preparing for its next major leg upward — as long as the macro narrative continues to support the return of easy money.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.