Bitcoin has surged past the $110,000 mark, hitting its highest level since June 11, 2025. The sharp upswing is primarily driven by strong inflows into U.S.-listed spot Bitcoin exchange-traded funds (ETFs)—a renewed wave of institutional interest that signals growing confidence in crypto markets.

BTC Hits New Local High Amid ETF Demand

On July 3, Bitcoin crossed the $110,000 threshold, extending its multi-week rebound. The milestone marks the strongest price level in nearly a month, with bulls regaining momentum amid favorable macro and regulatory conditions.

Bitcoin’s breakout reflects a shift in sentiment as large-scale investors re-enter the market via regulated financial instruments like spot ETFs.

According to industry data, U.S.-listed Bitcoin spot ETFs saw net inflows exceeding $540 million over the last five trading sessions. The surge in demand follows positive market performance, macroeconomic stability, and anticipation surrounding potential interest rate decisions from the U.S. Federal Reserve.

Institutional Adoption Leads the Charge

Since their launch in January 2025, spot Bitcoin ETFs have become a gateway for institutional investors, providing secure, regulated exposure to Bitcoin without needing to hold the asset directly.

Analysts say the current rally is being driven more by “spot market accumulation” than derivatives speculation, a sign of healthy long-term investment behavior.

Major players such as BlackRock, Fidelity, and Grayscale have reported growing investor interest, particularly from pension funds and family offices—further legitimizing Bitcoin as an alternative store of value in traditional portfolios.

Technical Outlook: Resistance Ahead?

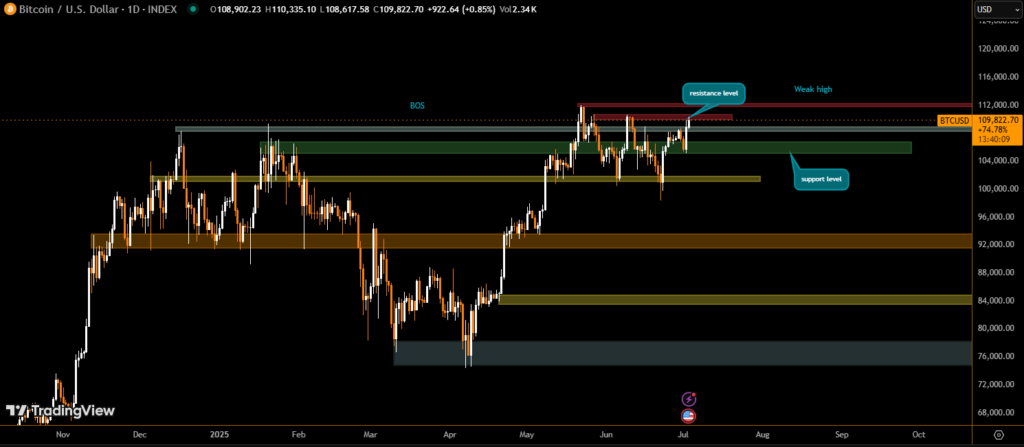

With BTC/USD trading at $110,300 as of the latest update, traders are eyeing resistance near $111,800–$112,500, the high set during the first week of June. A decisive break above this zone could pave the way for a move toward the $115,000–$120,000 range.

Support now rests near $106,800 and $104,200, where heavy buying interest was observed during the recent consolidation phase.

Bullish Momentum Builds

Bitcoin’s return above $110K marks a significant milestone in its 2025 trajectory, fueled by ETF inflows, institutional confidence, and robust market structure. As volatility returns, investors will closely monitor upcoming macroeconomic events and ETF flows for confirmation of the next major move.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.