Bitcoin has broken the $119,000 threshold, reaching a fresh all-time high. This milestone highlights an ongoing institutional-led surge, underpinned by massive ETF inflows, technical momentum, and bullish economic indicators.

Bitcoin Price Action: From Stability to Surge Above $119K

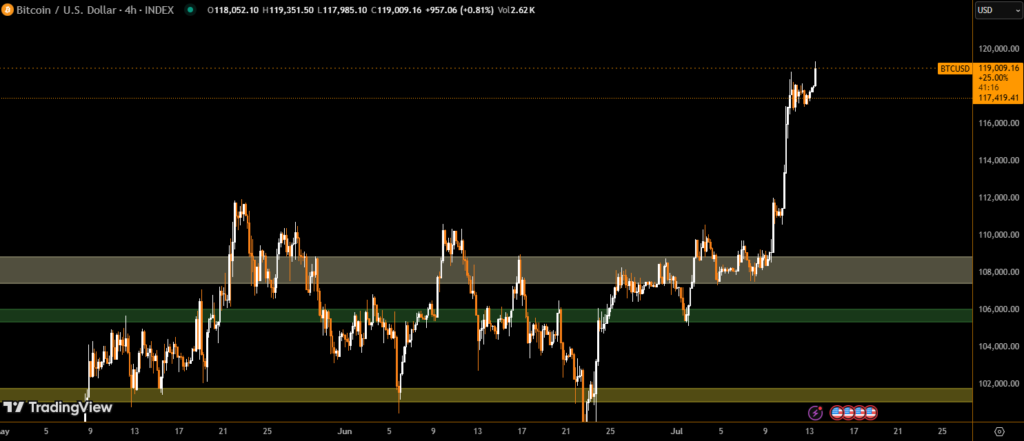

As of July 13, 2025, Bitcoin trades around $118,930, with intraday highs near $119,130 and lows near $117,041 . This move—driven by a 26% gain year-to-date—shows growing investor confidence and shifts in supply dynamics.

Fuel Behind the Breakout: ETF Inflows & Market Dynamics

A wave of spot Bitcoin ETF inflows has powered this rally. U.S.-listed BTC ETFs saw over $1 billion in daily inflows, part of a $2.7 billion weekly surge, propelling Bitcoin toward $119,000 BlackRock’s IBIT alone netted $448 million in inflows and now manages over $80 billion in BTC assets etf.com+4CoinDesk+4AInvest+4.

On-chain shifts reflect this institutional demand: exchange-held reserves dropped sharply to ~2.07 million BTC, signaling strong accumulation .

Economic Drivers: Rate Cuts & Regulatory Tailwinds

Analysts are linking Bitcoin’s growth to expectations of an interest-rate cut by the Fed in September, which favors risk assets like crypto . Simultaneously, pro-crypto policies, including the Genius Act and pending digital-asset legislation in the U.S. Congress, are boosting market sentiment .

Technical Outlook: Momentum Builds Toward $120K+

Technical analysis shows Bitcoin clearing its 7-day moving average (~$112,678) and key Fibonacci retracement at $114,001 . Short squeezes—liquidating over $1 billion in short positions—have accelerated upside pressure . Technical analysts now highlight potential moves toward $134,500, with a solid base formed at $108,300 .

Why This Rally Matters for Bitcoin’s Future

- Underlined fact: Exchange reserves falling reflect long-term holding behavior.

- Institutional legitimacy via ETFs aligns Bitcoin more with gold-like assets .

- Political and monetary support continues, improving confidence across markets.

Outlook: Is $150K–$200K Within Reach?

Looking ahead, major forecasts suggest Bitcoin may climb to $150,000–$200,000 by late 2025, fueled by ongoing ETF demand, macroeconomic easing, and regulatory clarity. However, caution remains as broader risks may trigger interim corrections.

Conclusion

Bitcoin’s rise above $119,000 represents a pivotal moment in 2025’s rally—driven by institutional adoption, market structure shifts, and macroeconomic tailwinds. If these trends hold, a sustained move towards $150K+ seems increasingly plausible.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.