BTC Hits $2.4 Trillion Valuation Amid ETF Surge and Institutional Accumulation

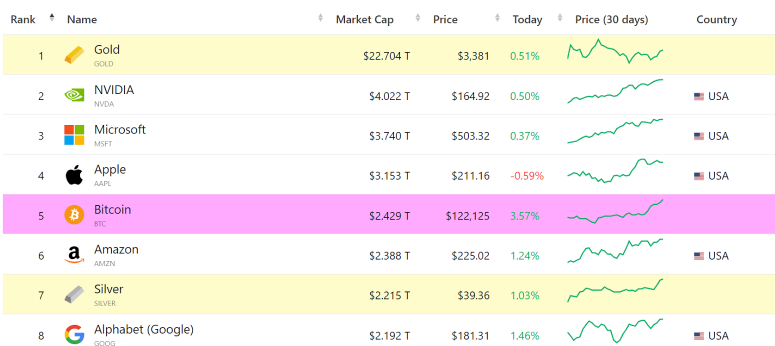

Bitcoin (BTC) has officially overtaken Amazon in market capitalization, becoming the fifth-largest asset globally. On Monday, Bitcoin’s price surged past $122,600, pushing its total market cap above $2.4 trillion — surpassing Amazon’s $2.3 trillion, silver’s $2.2 trillion, and even Alphabet (Google) at $2.19 trillion.

This historic move places Bitcoin directly behind only Apple, Microsoft, Saudi Aramco, and Nvidia on the global asset leaderboard.

ETF Inflows Fuel Bitcoin’s Price Explosion

One of the strongest catalysts for Bitcoin’s recent rally has been a seven-day buying streak by U.S. spot Bitcoin ETFs. These funds added over $1 billion in net inflows just last week, according to Farside Investors data.

The surge in ETF demand has dramatically increased Bitcoin’s liquidity and price stability, contributing to its breakout above key psychological levels.

As of now:

- Over 1.4 million BTC (approximately 6.6% of total supply) is held in spot Bitcoin ETFs.

- Another 853,000 BTC (around 4%) resides in the treasuries of public companies.

- A total of 3.5 million BTC is now held by corporate and institutional entities.

Corporate Bitcoin Holdings Double in One Month

Institutional interest in Bitcoin is accelerating. Since June 5, the number of companies holding BTC on their balance sheets has grown from 124 to 265 — more than doubling in just over a month. This signals rising adoption among publicly traded firms and financial institutions, many of which are leveraging Bitcoin as a strategic inflation hedge and long-term store of value.

Crypto Week Legislation Sparks Confidence

Bitcoin’s momentum has also been amplified by favorable regulatory developments in the United States. As part of a government-led initiative dubbed “Crypto Week,” lawmakers are actively debating:

- The GENIUS Act (stablecoin oversight)

- The CLARITY Act (crypto market regulations)

- The Anti-CBDC Surveillance State Act (opposing central bank digital currencies)

These bills are widely viewed as supportive of decentralized finance and private digital assets, boosting investor sentiment across the sector.

What Comes Next?

With Bitcoin’s market cap now closing in on Apple, and ETF inflows continuing, analysts believe the digital asset may soon challenge even bigger giants — especially if upcoming regulatory clarity draws in more traditional capital.

As BTC cements its place among the world’s most valuable assets, the narrative is shifting. Bitcoin is no longer just an alternative currency — it’s now a globally recognized financial instrument, mainstream investment vehicle, and macroeconomic indicator.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.