BTC Price Pulls Back After Rally, Analysts Eye $103K as Crucial Level for Next Move

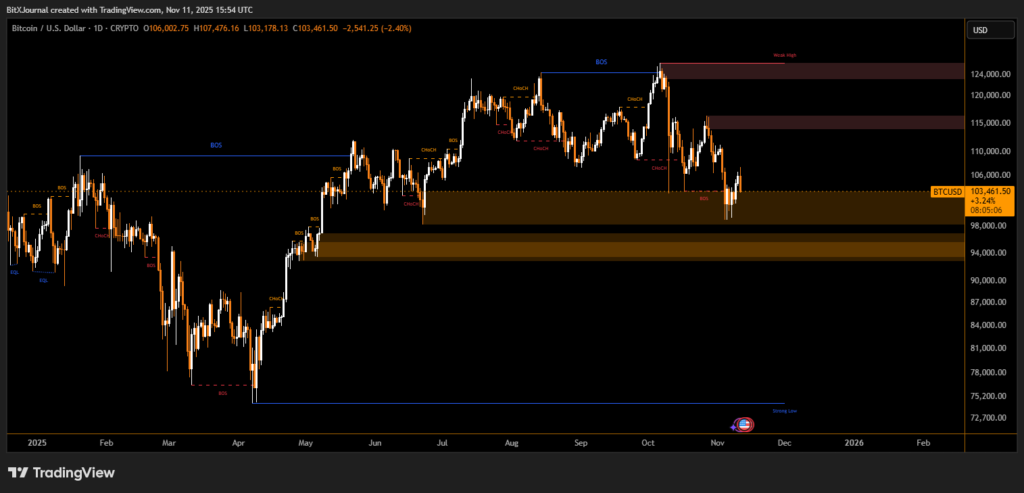

Bitcoin (BTC) has pulled back sharply from recent highs, dropping to retest the $103,000 demand zone — a level that technical traders view as a potential short-term support. The move follows a period of heightened volatility and a clear break of structure (BOS) visible on daily charts.

Technical Breakdown

According to the latest TradingView chart data, Bitcoin declined nearly 2.6% to $103,256, extending losses from its earlier peak near $107,400. The chart highlights multiple change of character (ChoCH) and break of structure (BOS) formations, suggesting that momentum has shifted from bullish to neutral as buyers attempt to absorb selling pressure.

BitXJournal Analysts point out that $103K represents a significant liquidity pocket aligned with prior accumulation zones from late September and early October. Beneath this level, another strong demand area lies between $98,000 and $94,000, where large buy orders could provide support.

“The $103K region is acting as an initial defense zone for bulls,” said a market analyst from BitXJournal . “If buyers hold this structure, we could see a rebound toward the $110K–$115K resistance area. A failure here, however, exposes BTC to deeper retracement into the mid-$90K range.”

The broader market tone remains cautious amid profit-taking and macroeconomic uncertainty, though long-term trend structure on higher timeframes remains intact. Technical indicators, including equal lows (EQL) and strong low formations, indicate that Bitcoin’s overall bullish structure has not yet been invalidated.

Some traders are eyeing the $115K resistance zone — identified as a previous weak high — as the next major upside target if momentum returns.

“Bitcoin continues to respect key demand areas, showing signs of accumulation,” another analyst noted. “Institutional inflows remain steady, which could stabilize price action as the market consolidates above six figures.”

For now, the $103K level stands as the decisive battleground, where Bitcoin’s next trend direction will likely be determined. A bounce could confirm renewed bullish sentiment, while a break below could trigger a deeper correction before the next rally phase.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.