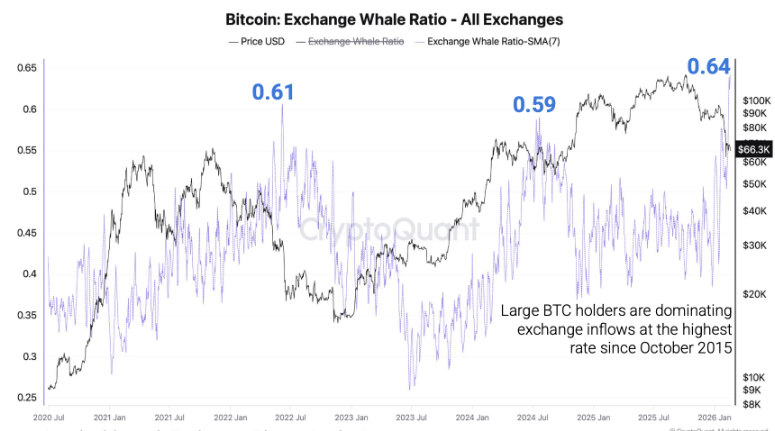

Large holders of Bitcoin are increasingly dominating exchange inflows, signaling elevated selling pressure during the ongoing bear phase, according to new data from CryptoQuant.

The firm reports that the exchange whale ratio has climbed to 0.64 its highest level since October 2015. This means 64% of all Bitcoin deposits to exchanges are coming from the top 10 transactions by volume. Historically, such concentration suggests that major investors, often referred to as whales, are leading distribution activity.

Bitcoin Exchange Inflows and Market Capitulation Trends

Earlier this month, as Bitcoin corrected toward the $60,000 range daily exchange inflows spiked to nearly 60,000 BTC on Feb. 6, marking the highest level since late 2024. Since then, inflows have eased to around 23,000 BTC on a seven day moving average a roughly 60% decline indicating that the most acute phase of selling may have cooled, though flows remain elevated compared to prior months.

The average exchange deposit size has also risen to 1.58 BTC in February, the highest since mid-2022, another period associated with deep market weakness.

Stablecoin Inflows Drop, Altcoin Selling Expands

Liquidity conditions appear tighter. Net daily inflows of Tether into exchanges have fallen sharply from $616 million in November to just $27 million recently, with occasional net outflows.

Meanwhile, altcoin exchange deposits have increased 22% compared to late 2025 levels, pointing to broader risk reduction across the crypto market and heightened volatility risks ahead.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.