Large Bitcoin holders have quietly rebuilt positions despite months of market weakness, effectively reversing a 230,000 BTC distribution phase that began in late 2025. Wallets holding between 1,000 and 10,000 BTC increased their combined balance from 2.86 million BTC in December 2025 to approximately 3.09 million BTC, returning to levels seen before the October 10 market crash.

The rebound suggests a V shaped accumulation pattern among major players. After Bitcoin peaked near $124,000 in August 2025, whale reserves declined during the subsequent correction. However, data shows that nearly 98,000 BTC were accumulated in just the past 30 days, fully offsetting earlier drawdowns.

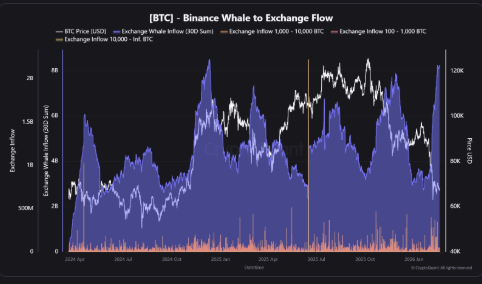

Exchange Flow Data Shows Rising Large-Order Activity

Spot market metrics reinforce the accumulation trend. Throughout 2026, average Bitcoin order sizes have ranged between 950 BTC and 1,100 BTC, marking one of the most sustained periods of large block trading since late 2024. This contrasts with previous corrections, where retail-driven activity dominated.

On the exchange side, whale related Bitcoin flows into Binance reached $8.24 billion over the past month, a 14-month high. At the same time, gross whale withdrawals averaged 3.5% of total exchange held supply on a rolling 30-day basis, translating to roughly 60,000 to 100,000 BTC moving off platforms.

Although inflows have increased, elevated withdrawal rates indicate that much of the deposited Bitcoin is being absorbed into long-term custody rather than remaining on exchanges. The shift suggests institutional and high net worth participants may be positioning ahead of potential volatility or a broader market recovery.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.