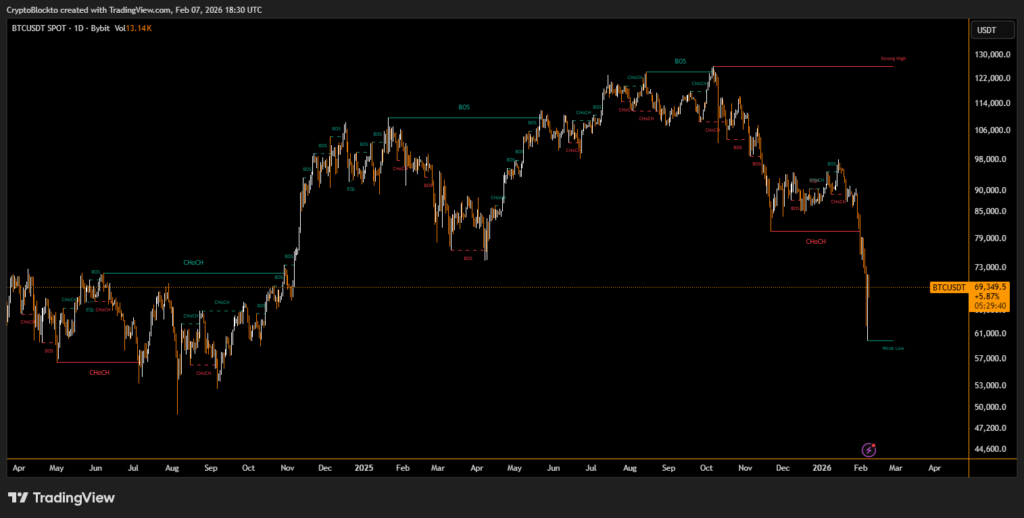

Bitcoin’s recent slide of nearly 50% from its highs has reignited concerns about the asset’s resilience, but hedge fund veteran Gary Bode argues the move is consistent with bitcoin’s long-standing market behavior rather than a sign of systemic trouble.

Bitcoin Volatility Matches Historical Patterns

According to Bode, sharp drawdowns are a defining feature of bitcoin’s history. Past market cycles have seen declines of 80% or more, followed by strong recoveries over longer time horizons. From this perspective, the latest selloff fits a familiar pattern of extreme volatility rather than signaling a breakdown in fundamentals.

Bode attributes much of the recent pressure to market misinterpretation of US monetary policy. Investors reacted to expectations of tighter Federal Reserve policy, triggering margin calls and forced liquidations across leveraged positions. He contends that these fears may be overstated, noting that longer-term interest rates are influenced as much by fiscal deficits as by central bank leadership.

Whale Selling and “Paper Bitcoin” Effects

Short-term headwinds also include profit-taking by large bitcoin holders and concerns around corporate balance sheets tied to bitcoin exposure. In addition, the growth of exchange-traded products and derivatives has expanded “paper” bitcoin trading, which can amplify price swings without changing the asset’s fixed supply of 21 million coins.

Despite near-term turbulence, Bode maintains that bitcoin’s core attributes—capped supply, permissionless ownership, and independence from counterparties—remain unchanged. In his view, volatility is not a flaw but a defining characteristic that long-term investors must be willing to endure.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.