Bitcoin’s reputation for delivering strong gains in November is facing fresh scrutiny this year, as the market leader struggles to regain footing after a sharp weekly decline.

Over the past seven days, Bitcoin briefly slipped below the $90,000 mark and has shed more than 15% since the start of the month — positioning November 2025 to be its weakest since 2019, according to data from CoinGlass.

James Harris, CEO of the crypto yield platform Tesseract, cautioned against leaning too heavily on historical averages. He noted that while past Novembers often paint a bullish picture, the data is “skewed” by outlier years and doesn’t reflect today’s market environment.

“Historical averages suggest strength, but those numbers are skewed and the current backdrop is anything but normal,”

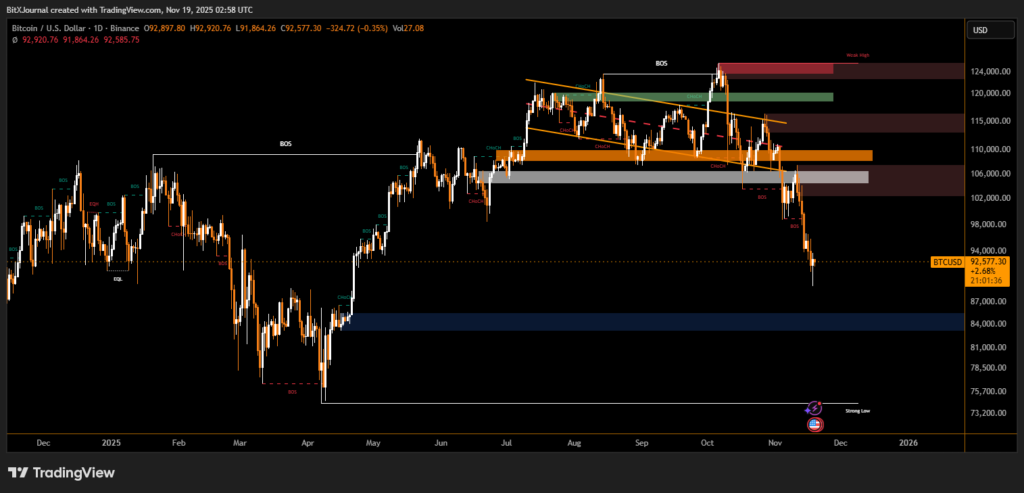

At the time of writing, Bitcoin is changing hands near $93,290 — up about 1% in the last 24 hours after rebounding from a brief dip under $89,400.

Macro pressures blur historical comparisons

This year’s market environment is far from typical. A six-week U.S. government shutdown delayed key economic data releases, compressing an entire backlog of inflation and rate-related information into a short window once operations resumed.

Harris said the sudden influx forced investors to rapidly reassess interest rate expectations. Confidence in a Federal Reserve rate cut at the December meeting has sunk to 41%, according to the CME FedWatch Tool — a sharp shift for a market that was previously leaning bullish.

New all-time high still possible — but not expected

Despite the recent turbulence, Harris did not rule out the possibility of Bitcoin revisiting all-time highs before year-end. Still, he stressed that his firm isn’t forecasting such a move.

Bitcoin last reached a record above $125,000 in early October, which briefly reignited hopes for another strong November — historically its best-performing month with an average return of 41% since 2013. However, that figure is heavily distorted by 2013’s explosive 449% surge, an anomaly that analysts say heavily skews long-term averages.

Signs of stabilization emerge

Bitfinex analysts believe the market may be nearing the end of its current drawdown. They said that across past cycles, meaningful bottoms typically don’t form until short-term holders capitulate into losses — a dynamic now taking shape.

“It feels like it is time for a local bottom to be established relatively soon,” the team said, noting early indications that selling pressure is starting to cool.

Analysts at B2BINPAY echoed the sentiment, saying a swift recovery remains possible once buyers reassert control. They pointed to $97,000–$100,000 as the nearest major resistance band.

Until that zone is retested, they added, market sentiment is likely to remain cautious.

With Bitcoin still struggling to regain momentum, the rebound traders hoped to see in November may instead spill into December — if improving market signals continue to build.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.