Analysts warn that reduced illiquid holdings could limit Bitcoin’s rally momentum unless new demand emerges

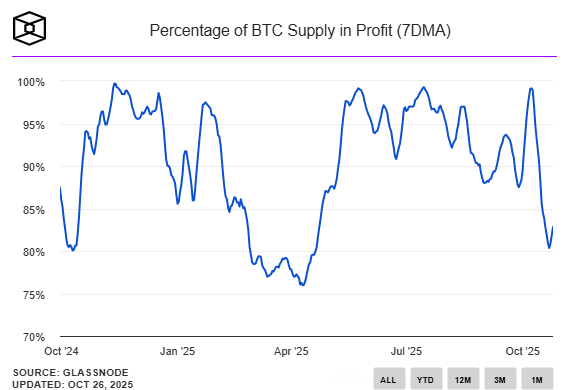

The illiquid supply of Bitcoin — coins held in long-term, inactive wallets — has begun to decline for the first time in months, signaling a potential shift in market dynamics. According to Glassnode, around 62,000 BTC, worth approximately $7 billion, has moved out of long-term holder wallets since mid-October, as traders respond to cooling price momentum and macroeconomic uncertainty.

Glassnode data shows that this is the first significant drawdown in Bitcoin’s illiquid supply during the second half of 2025. The outflows follow Bitcoin’s retreat from its all-time high above $125,000 in early October to around $113,550 as of this week.

“What’s interesting is that whale wallets have actually been accumulating during this phase,” Glassnode wrote on X. “Over the last 30 days, whale wallets have grown their holdings, and since October 15th, they haven’t largely sold their positions.”

Market Liquidity and Price Impact

The movement of long-held Bitcoin into more liquid wallets typically increases available supply, which can make it harder for prices to sustain a rally without strong spot demand. With first-time buyers remaining flat, the imbalance between supply and new inflows is adding pressure to Bitcoin’s current price levels.

Despite recent outflows, long-term scarcity remains a central theme in Bitcoin’s investment thesis. A Fidelity Digital Assets report estimates that if current holding trends continue, about 42% of Bitcoin’s total supply — roughly 8.3 million BTC — will be considered illiquid by Q2 2032.

“Over time, the scarcity of Bitcoin may become the focal point as more entities buy and hold the asset long term,” the report noted, adding that nation-state adoption and regulatory clarity could accelerate this trend.

While the decline in illiquid Bitcoin supply suggests short-term caution among holders, analysts emphasize that the broader accumulation by whales and institutional players may signal confidence in Bitcoin’s long-term trajectory. However, until stronger spot demand returns, the market could remain under pressure, making the next few weeks critical for determining whether Bitcoin’s consolidation turns into a renewed rally.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.