As Bitcoin (BTC) grapples with a growing liquidity crunch, the impact is being felt across the altcoin market — and XRP is no exception. With BTC volatility rising and order book depth thinning, traders are becoming increasingly cautious, leading to downward pressure on many digital assets, including XRP.

Despite its long-term potential and solid fundamentals, XRP remains tightly correlated with Bitcoin’s market sentiment. As a result, the question arises: Can XRP break past key resistance and reach $3, or will macro liquidity conditions keep it grounded?

Bitcoin’s Liquidity Dilemma: A Market-Wide Domino Effect

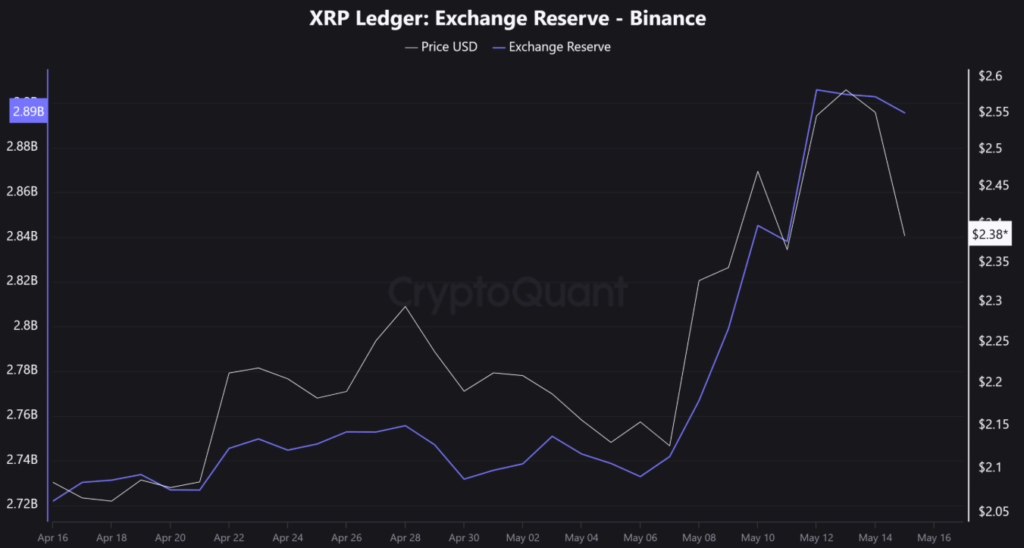

Recent data from on-chain analytics platforms show that Bitcoin’s liquidity on centralized exchanges is at multi-year lows, partly due to long-term holders accumulating and institutional entities taking BTC off exchanges. While this is often seen as bullish for BTC’s long-term price trajectory, the immediate impact is heightened volatility and fragility in the broader crypto market.

This kind of instability often dampens risk appetite, and altcoins like XRP usually suffer as a result. With reduced capital flow and cautious investor behavior, altcoins need strong independent catalysts to break free from Bitcoin’s gravitational pull.

XRP’s Technical Picture: A Tense Breakout Zone

Technically, XRP is hovering just below major resistance levels near $0.75, and analysts suggest that a confirmed breakout above this level could open the door to $1+ targets in the short term. However, for XRP to reach $3, a level last seen in 2018, it would need:

- A significant market-wide bullish catalyst

- Positive developments in the Ripple vs. SEC lawsuit

- A sustained return of retail and institutional liquidity

Fundamentals Remain Strong, But Sentiment Rules Short-Term

Despite current market headwinds, XRP still enjoys strong fundamentals:

- Ripple’s global partnerships with banks and payment networks

- Growing adoption in Asia and Latin America

- A resilient community and strong developer base

However, in a liquidity-starved market, sentiment often outweighs fundamentals. As such, XRP’s short-term performance is likely to remain volatile and heavily influenced by Bitcoin’s price action.

Conclusion: XRP Needs a Clear Breakout – and Market Support

While XRP has the long-term potential to reclaim or even surpass the $3 mark, doing so in the current climate will be difficult without broader crypto market support. As Bitcoin navigates a period of reduced exchange liquidity, altcoins will need to prove their worth — or wait patiently for stronger tailwinds.

For now, all eyes remain on Bitcoin — and XRP holders will need to watch the charts and news closely.