Bitcoin Market Analysis: Is the Rally Near Its Peak?

Bitcoin’s relentless surge above $114,000 has sparked new debate among analysts over whether the world’s largest cryptocurrency is pricing out retail investors, potentially threatening the longevity of the current bull market.

According to 10x Research, Bitcoin’s rapid appreciation and diminishing returns are creating conditions that could end the extended market cycle narrative. The firm’s latest report noted that while institutional demand continues to grow, retail participation — historically a key driver of market momentum — is beginning to wane due to affordability concerns.

“Bitcoin is suffering from diminishing returns,” the report stated, suggesting that the cryptocurrency’s maturity may come at the cost of reduced accessibility.

Technical and Market Implications: Can the Cycle Sustain?

The data shows that Bitcoin’s four-year market cycle theory may no longer hold the same predictive power it once did. As 10x Research highlighted, drawing “firm statistical conclusions” from a mere 16 years of price data is “highly questionable.”

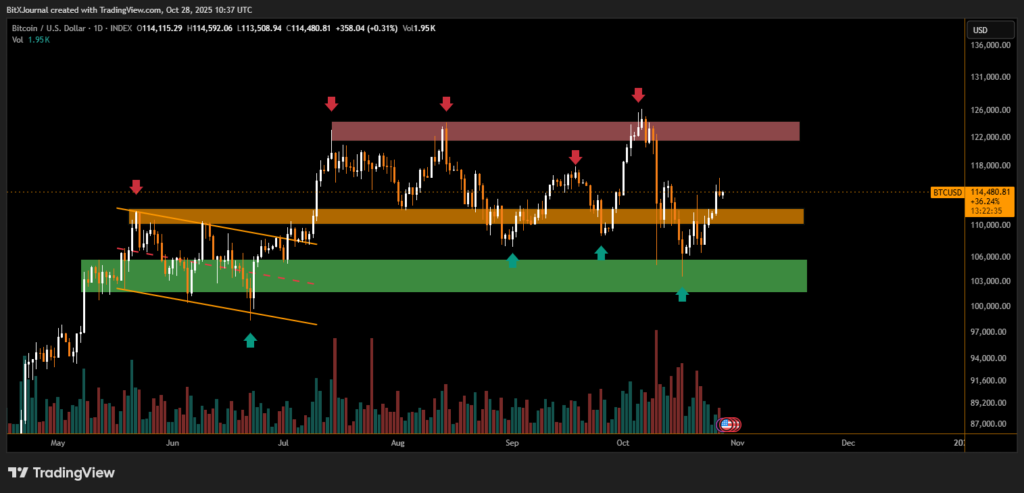

Despite predictions from models like stock-to-flow, which forecast Bitcoin reaching $1 million, 10x Research projects a more modest cycle top of $125,000 by the end of 2025. Their methodology — which accurately pinpointed the October 2022 bear market bottom — suggests a flattening growth curve rather than an exponential continuation.

Institutional investors, including major funds and corporate treasuries, continue to dominate Bitcoin accumulation. However, the report warns that reduced retail participation could lead to lower liquidity and weaker volatility-driven rallies, both essential characteristics of previous bull runs.

Meanwhile, Standard Chartered’s digital assets head Geoff Kendrick offered a more optimistic view, suggesting Bitcoin could still reach $200,000 by late 2025 if macroeconomic conditions favor digital asset inflows.

With Bitcoin now seen as a store of value rather than a speculative vehicle, some analysts argue that its maturing nature is inevitable. However, others warn that if retail investors continue to step back, the market’s cyclical momentum could fade faster than expected.

The next few months may determine whether Bitcoin’s rally transitions into a sustainable, institutionally driven phase or begins a natural cycle cooldown — signaling the start of a new era for digital assets.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.