A leading market researcher argues that Bitcoin is trading far below where macro conditions suggest it should be, creating one of the strongest upside profiles in years.

Bitcoin Market Outlook Signals Strong Asymmetric Upside

Bitcoin may be entering one of its most favorable macro positions since the early months of the COVID-19 crisis. According to market analyst André Dragosch, the current environment presents an “asymmetric risk-reward” profile similar to March 2020, when global uncertainty pushed Bitcoin below $5,000 before it began a historic multi-year rally.

Dragosch argues that Bitcoin is currently “pricing in a recessionary growth environment”, despite improving indicators across major economies. He says the asset has already absorbed most of the negative macro expectations, including tightening monetary policies and the long shadow cast by recent market disruptions.

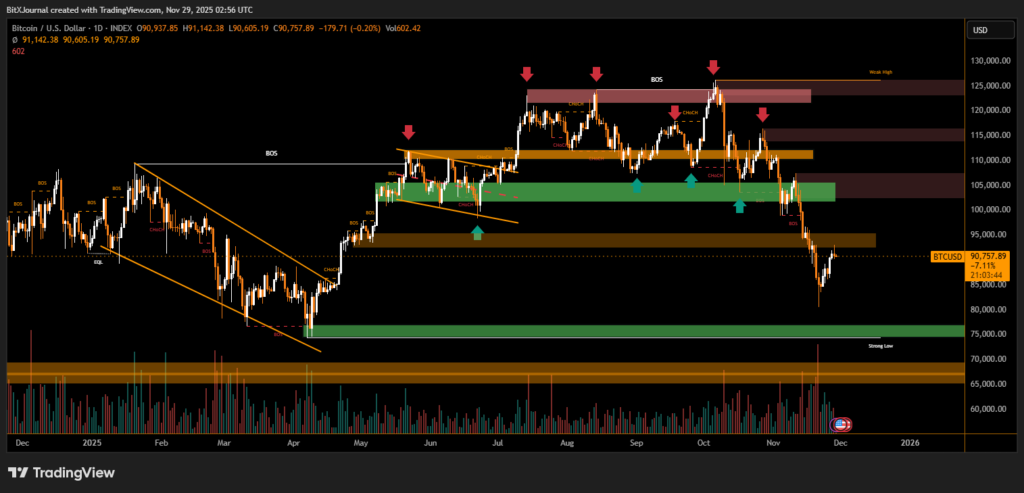

Bitcoin’s price has faced notable pressure in recent months. After reaching new all-time highs of $125,100 in early October, the market reversed sharply following a $19 billion liquidation spike on Oct. 10. Sentiment weakened further as Bitcoin fell below the key $100,000 level in mid-November and briefly touched lows under $90,000.

Despite this, Dragosch believes the macro backdrop is turning more supportive. He highlights the delayed boost of previous monetary stimulus, which historically lifted global growth well into the years following COVID-19. He suggests that a similar expansion cycle could take shape heading into 2026.

Other market observers also see signs of resilience. Traders note that similar market corrections have historically preceded strong rallies in nearly 75% of cases. Meanwhile, industry voices expect Bitcoin to reclaim major levels, with projections that it could return above $100,000 before the end of the year.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.