Crypto mining company Bitdeer has liquidated its entire corporate reserve of Bitcoin, reducing its holdings to zero in a move that stands out within the mining sector.

In its latest operational update, the firm reported producing 189.8 BTC during the week and selling the full amount. In addition, Bitdeer offloaded 943.1 BTC from its existing treasury — the same balance it reported holding just a week earlier. As a result, the company’s “pure holdings,” excluding customer-related balances, have dropped to zero.

Bitcoin Miner Treasury Strategy and Market Pressure

Mining companies typically sell part of their production to cover operational costs such as electricity, hosting and hardware expenses, while maintaining treasury reserves to retain exposure to Bitcoin’s long-term price potential. Fully clearing reserves is relatively uncommon and may reflect liquidity planning or strategic repositioning.

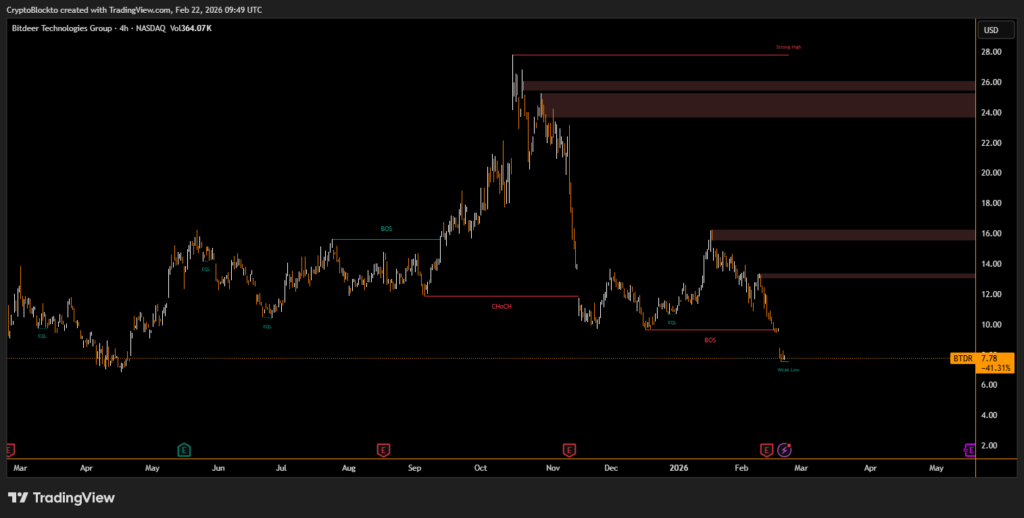

The announcement coincided with a sharp decline in Bitdeer’s share price after it revealed plans to raise $300 million through convertible senior notes due in 2032, with an option to increase the offering by $45 million. Proceeds are earmarked for data center expansion, AI cloud services and mining hardware development.

Crypto Miners Pivot Toward AI Infrastructure

The development comes amid broader industry shifts. Firms including MARA Holdings, Hut 8 and HIVE are increasingly diversifying into artificial intelligence and high-performance computing to offset post-halving margin pressure.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.