Stable, a blockchain network backed by cryptocurrency exchange Bitfinex, has announced a major partnership with PayPal Ventures to integrate PayPal USD (PYUSD) onto its platform. The move is expected to expand PYUSD’s presence across blockchain ecosystems and accelerate adoption in global payments.

PayPal Expands PYUSD Utility

In a statement, David Weber, head of the PYUSD ecosystem, emphasized that the collaboration with Stable reflects PayPal’s commitment to increasing PYUSD’s utility across multiple networks. Stable’s focus on fast, seamless financial transactions made it an ideal partner for this expansion.

Launched in August 2023 with Paxos, PYUSD has grown steadily to become the 11th largest stablecoin, holding a market cap of around $1.4 billion. While it trails far behind Tether’s USDT ($172 billion market cap), the partnership with Stable is expected to unlock new commerce-related use cases for PYUSD in emerging markets.

Stable’s Role in the Ecosystem

Stable is a layer-1 blockchain designed for institutional-grade payments, remittances, and cross-border transactions. The project officially came out of stealth in July 2025 after securing a $28 million seed funding round co-led by Bitfinex and Hack VC.

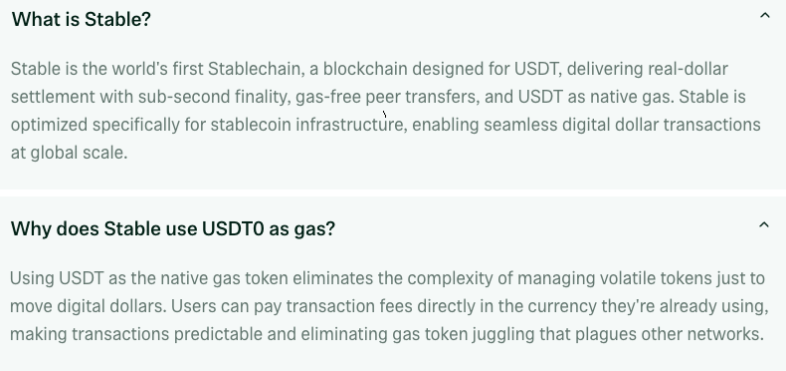

The blockchain is closely tied to Tether USDt (USDT), with its infrastructure built to deliver:

- Sub-second finality

- Gas-free peer-to-peer transfers

- USDT as the native gas token

Stable’s design aims to eliminate the volatility and complexity of traditional blockchain gas fees by relying on stablecoins such as USDT. The platform is also connected to USDT0, a cross-chain liquidity stablecoin developed by Everdawn Labs.

Why It Matters for PYUSD

The integration of PYUSD on Stable opens the door for real-world adoption in emerging markets, where dollar-based digital payments are in high demand. According to Amman Bhasin, a partner at PayPal Ventures, the investment in Stable is part of a strategy to target markets where reliable dollar payments can have the greatest impact.

This partnership is expected to strengthen PYUSD’s positioning against other stablecoins by diversifying its use cases beyond PayPal’s own ecosystem.

With Tether’s dominance in the market, PYUSD still faces an uphill climb in terms of scale. However, collaborations with networks like Stable could accelerate its growth by making it a go-to option for commerce, cross-border payments, and decentralized finance (DeFi) applications.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.