Rising Bitcoin prices and increased hashrate drive massive growth in mining demand

Bitcoin Price Rally Powers BitFuFu’s Growth

Singapore-based Bitcoin mining company BitFuFu has reported a 100% increase in revenue for the third quarter compared to the same period last year. The growth was driven by soaring Bitcoin prices, heightened cloud mining demand, and a surge in equipment sales as miners raced to capitalize on rising market momentum.

According to the company’s Q3 earnings report, total revenue reached $180.7 million, up from $90 million a year earlier. The firm’s cloud mining division alone generated $122 million, highlighting the growing appeal of accessible mining models that don’t require users to manage physical hardware.

Cloud Mining Demand Surges Alongside Bitcoin’s Price

BitFuFu’s customer base expanded rapidly, with cloud-mining users increasing 40% to 641,526 year-over-year. Meanwhile, mining equipment sales skyrocketed to $35 million, compared to just $0.3 million during the same quarter in 2024.

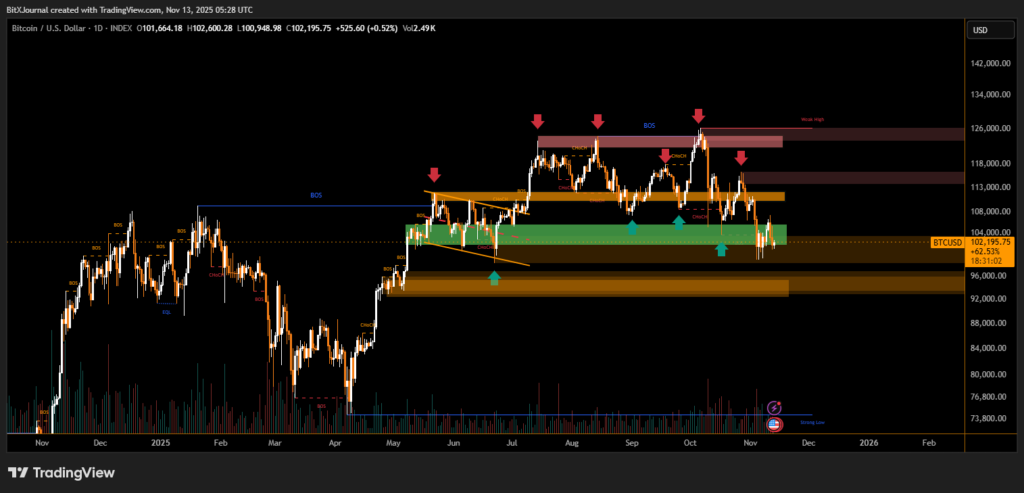

The average cost of Bitcoin rose to $114,500 in Q3 2025, compared to $61,000 a year earlier, significantly improving miners’ profitability. “This growth reflects strong demand for mining machines, supported by the sustained upward trend in Bitcoin prices,” the company said in its statement.

The global Bitcoin network hashrate also surged to 1.19 billion TH/s, up from 687.19 million TH/s last year, according to YCharts data — underlining how competition in mining continues to intensify.

Cloud mining remains attractive for many users because it eliminates the need to maintain or upgrade mining hardware, allowing investors to rent computing power and share in Bitcoin rewards.

Self-Mining and Diversified Model Drive Profitability

Following the April 2024 Bitcoin halving, many miners began reallocating capacity toward AI and high-performance computing hosting services. Despite this trend, BitFuFu continues to rely on self-mining operations as a vital revenue stream.

CEO Leo Lu explained, “Our strong third-quarter results demonstrate the benefits of our differentiated dual-engine model, combining recurring cloud-mining revenue with direct participation in Bitcoin price appreciation through our self-mining operations.”

He added that this model provides “multiple levers to manage volatility and sustain profitability through cycles.”

During the quarter, BitFuFu mined 174 Bitcoin and boosted total holdings by 19% to 1,962 BTC, strengthening its balance sheet as Bitcoin’s value continues to climb.

BitFuFu’s impressive quarterly performance reflects a broader resurgence in the Bitcoin mining industry, where higher prices and stronger network fundamentals have reignited investment. With a robust mix of cloud and self-mining operations, BitFuFu appears well-positioned to navigate future cycles and benefit from continued institutional and retail interest in digital assets.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.