Tom Lee reaffirms $60,000 target while company strengthens its treasury holdings

BitMine Immersion Technologies, the largest corporate holder of Ether, has purchased an additional $65 million worth of ETH, marking its first acquisition for September. The move highlights the growing wave of institutional accumulation as Ethereum reserves on centralized exchanges hit a three-year low.

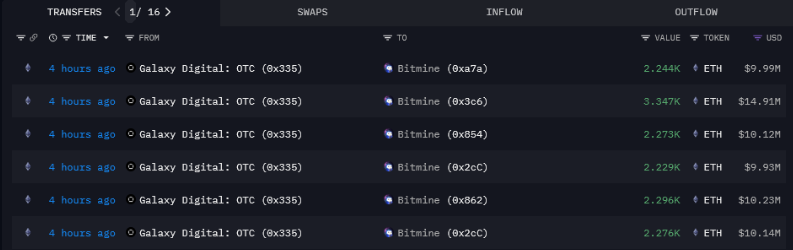

Blockchain analytics platform Arkham Intelligence reported that BitMine completed the transactions through Galaxy Digital’s over-the-counter desk, with six separate buys executed on Thursday. A company representative confirmed that the purchase was made without leverage: “All ETH is spot purchases with cash.”

With this latest acquisition, BitMine now controls more than 1.5% of Ethereum’s circulating supply — an amount positioning it as one of the most influential corporate players in the market.

Stock reaction and market momentum

Shares of BitMine Immersion Technologies (BMNR) closed Wednesday’s session at $44.86, up 5.58% on the day, before dipping slightly in after-hours trading. Despite being up 540% year-to-date, the stock remains nearly 67% below its July 3 peak of $135.

BMNR continues to be one of the most actively traded stocks, averaging over 50 million shares daily, reflecting strong investor attention.

Lee: Ethereum’s turning point moment

Speaking on the Medici Presents: Level Up podcast, BitMine chairman Tom Lee compared Wall Street’s adoption of Ethereum to a “1971 moment” — referencing the U.S. stock market’s surge following President Nixon’s economic measures that year.

“Wall Street moving onto crypto rails, I think, is like a 1971 moment for Ethereum,” Lee said. “It’s creating enormous opportunities to move financial activity onto the blockchain. Ethereum won’t be the only winner, but it will be one of the primary winners.”

Lee reiterated his long-term price target of $60,000 for ETH, arguing that companies with ETH treasuries deserve a valuation premium because they can stake their holdings to earn yield.

“ETFs cannot fully stake due to liquidity requirements, but corporations can — and that’s a major advantage,” he added, noting BitMine’s current NAV multiple of 1.13 could rise significantly as staking gains are factored in.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.