BitMine Immersion Technologies is facing mounting paper losses as the recent downturn in the crypto market continues to weigh heavily on Ether prices. The decline has highlighted the growing risks associated with corporate crypto treasury strategies, particularly during periods of deleveraging and weak market liquidity.

Ether Holdings Decline Amid Market Liquidations

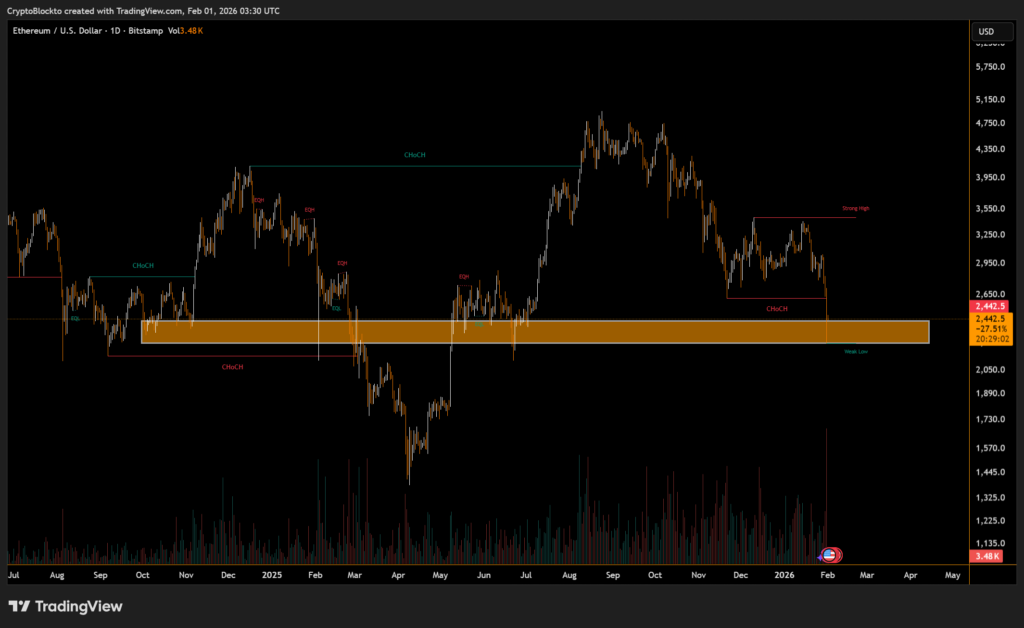

Following the acquisition of an additional 40,302 Ether last week, BitMine increased its total holdings to more than 4.24 million ETH. However, the timing coincided with a sharp market pullback. At current prices, the company’s Ether position is valued at approximately $9.6 billion, down from a peak near $13.9 billion recorded in October. This places BitMine’s unrealized losses at over $6 billion, reflecting the severity of the broader digital asset sell-off.

Despite earlier optimism for the end of 2025, Tom Lee has warned that conditions have shifted;

Fragile Liquidity Accelerates Price Drops

Ether briefly slid toward the $2,300 level as forced liquidations swept through the market. Analysts attributed the move to thin liquidity conditions combined with elevated leverage, which created sudden gaps in pricing once selling pressure intensified. Concentrated positioning among traders further amplified the decline, accelerating losses across major tokens.

Crypto Treasury Strategies Under Pressure

The situation underscores the challenges facing companies that rely on large crypto balance sheets. While long-term fundamentals remain a point of optimism for some market participants, near-term conditions suggest continued volatility. With risk appetite still recovering from previous market shocks, sustained improvement is likely to depend on stronger liquidity, renewed institutional demand and broader participation across the digital asset ecosystem.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.