The crypto market has been experiencing a prolonged downturn since early 2025, and while recent institutional activity has softened headline losses, underlying conditions point to a deep market cycle that may now be closer to recovery than further decline.

Crypto Winter Began Earlier Than Many Realized

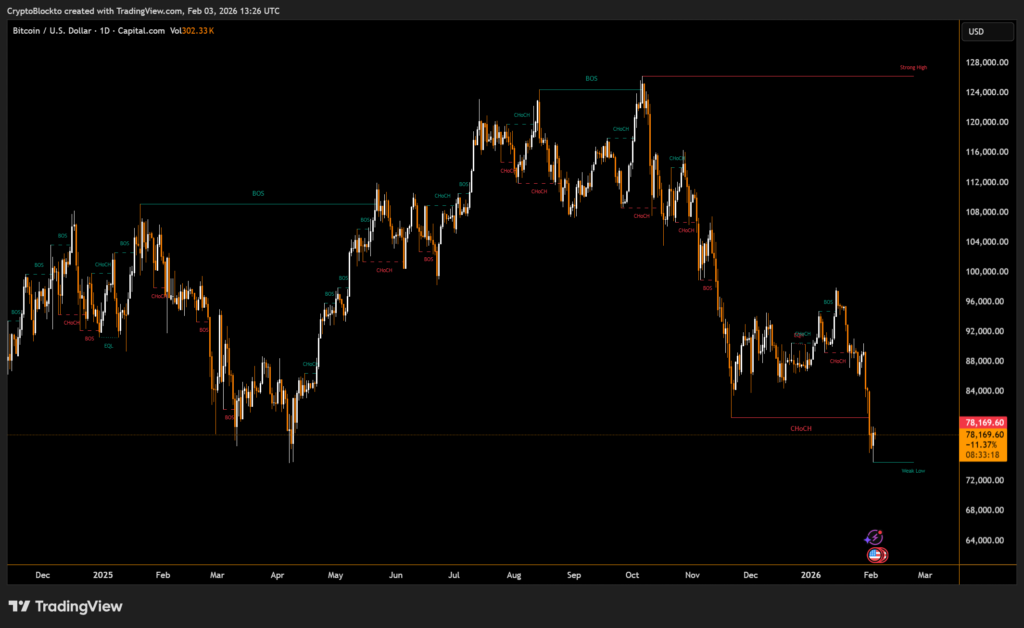

According to Bitwise Chief Investment Officer Matt Hougan, the current downturn should be viewed as a full-scale crypto winter rather than a short-term correction. While Bitcoin reached an all-time high in October 2025, Hougan argues that broader market weakness actually began around January 2025. That weakness was partially concealed by steady inflows into spot exchange-traded funds and corporate digital asset treasuries.

Bitcoin is down roughly 39% from its peak, while Ether has fallen more than 50%. Many smaller tokens have suffered even steeper losses, particularly those without access to institutional investment channels.

Institutional Flows Masked Deeper Declines

Hougan noted that assets with consistent institutional demand experienced smaller drawdowns, generally between 10% and 20%. In contrast, tokens lacking ETF exposure or treasury adoption declined more than 60%. During this period, ETFs and digital asset treasuries reportedly accumulated over 744,000 BTC, representing about $75 billion in demand that helped stabilize prices.

Historically, crypto winters last about 13 months from peak to trough. With the current cycle extending beyond a year, Hougan believes the market is likely closer to exhaustion than renewed collapse. He added that progress in regulation, tokenization, stablecoins, and institutional adoption continues despite weak prices, suggesting conditions consistent with past market bottoms rather than the start of a new decline.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.