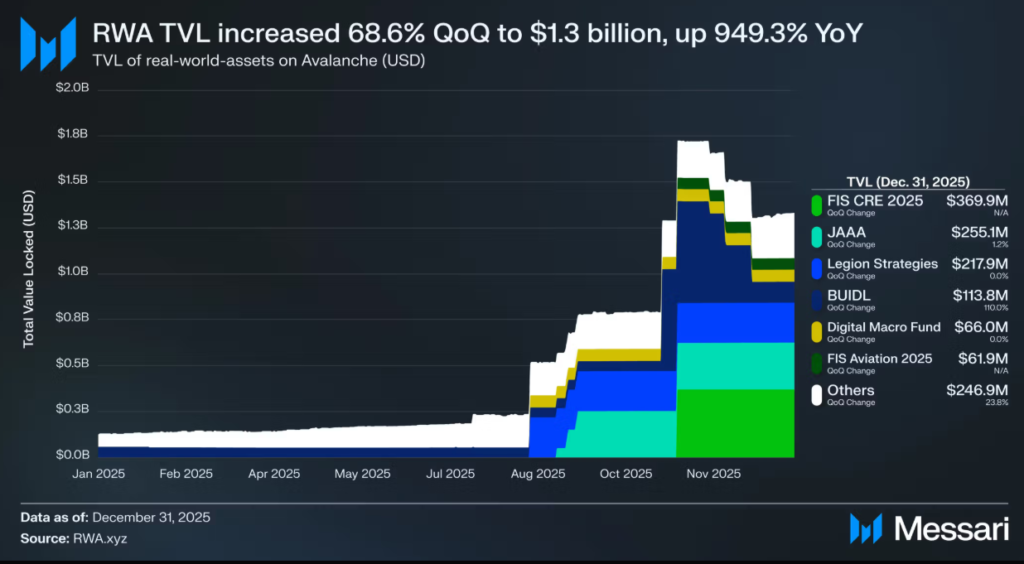

Avalanche recorded a sharp rise in institutional activity during the fourth quarter of 2025, led by growth in tokenized real-world assets such as money market funds, loans and financial indices. The total value locked in tokenized assets on the Avalanche network increased by 68.6% over the quarter and nearly tenfold over the year, reaching more than $1.3 billion.

A major catalyst was the launch of the BlackRock USD Institutional Digital Liquidity Fund (BUIDL) in November, which brought roughly $500 million in assets onto the Avalanche blockchain. The fund significantly boosted onchain activity tied to tokenized cash and short-term yield products, highlighting growing interest from traditional asset managers.

Beyond asset management, tokenized credit also contributed to Avalanche’s growth. A partnership between a major financial services provider and Avalanche-based platform Intain enabled the securitization of billions of dollars in loans, expanding institutional-grade use cases on the network.

Avalanche also supported the launch of a blockchain-based market index tracking crypto-related equities and digital assets, further strengthening its position as infrastructure for tokenized financial products.

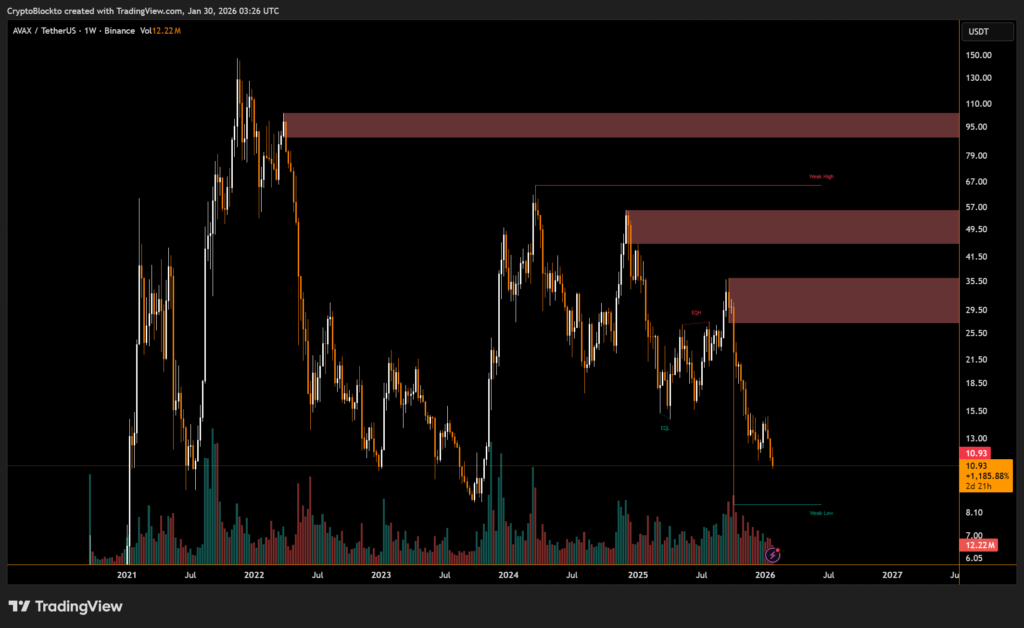

AVAX Token Lags Despite Network Growth

Despite strong onchain metrics, the AVAX token underperformed during the same period. The token fell nearly 60% in the fourth quarter of 2025 and has continued to slide in early 2026, standing well below its previous cycle highs.

Native decentralized finance activity on Avalanche improved, with the value locked in DeFi protocols rising more than 30% quarter over quarter and daily transactions climbing sharply. Stablecoin supply remained largely unchanged, though USDT became the dominant stablecoin on the network by the end of the year.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.