$14 Billion in Crypto Fund Inflows Marks Major Institutional Shift

BlackRock, the world’s largest asset manager with $11.5 trillion in assets under management, reported a significant spike in cryptocurrency fund inflows in Q2 2025, highlighting a shift in institutional investor behavior.

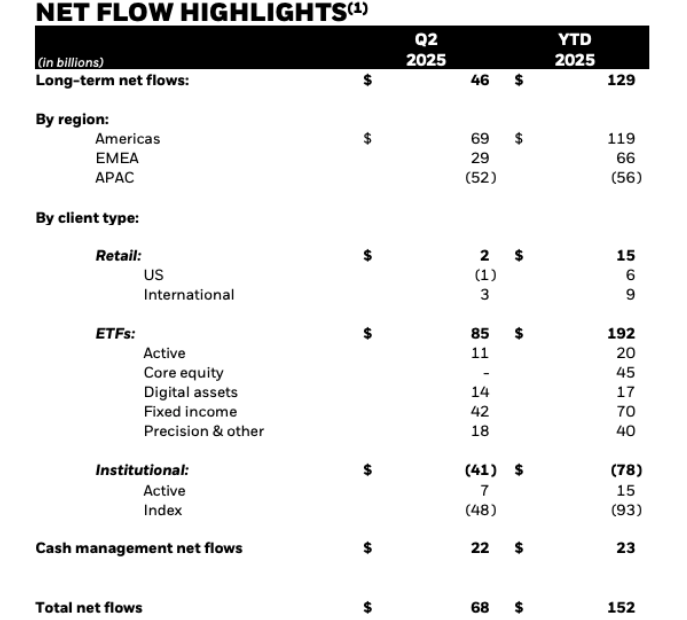

According to BlackRock’s Q2 earnings, crypto-related iShares ETF inflows surged by 366%, reaching $14 billion, compared to $3 billion in Q1. This growth represents 16.5% of all total ETF inflows for the quarter — a massive jump from just 2.8% in Q1 2025.

Net ETF Inflows Fall Amid One-Time Redemption

While crypto-specific inflows were sharply higher, BlackRock’s overall ETF inflows dropped 19% — falling from $84 billion in Q1 to $68 billion in Q2. The decline was primarily attributed to a single institutional client’s $52 billion partial redemption from a lower-fee index product, which skewed the broader data.

Despite this drop in net flows, the surging demand for digital assets underscores crypto’s growing role in BlackRock’s long-term strategy.

Digital Assets Now Generate 1% of Base Fees

As of June 30, 2025, digital asset products generated $40 million in base fees, up 18% from $34 million in Q1. This now accounts for approximately 1% of BlackRock’s total long-term revenue from base fees.

Although still a relatively small portion of overall revenue, BlackRock emphasized that digital assets represent a fast-growing contributor, with potential to scale further as adoption increases.

https://cointelegraph.com/news/blackrock-crypto-inflows-q2-total-flows-slump

Global Investor Demand Driving Crypto Growth

BlackRock CEO Larry Fink highlighted that iShares ETFs achieved a record first half for flows, and noted rising interest in digital assets and international product offerings. He also pointed to the success of the firm’s joint venture with Jio in India, indicating a broader push toward global retail and institutional investor access to emerging asset classes.

Fink stated, “We’re attracting a new and increasingly global generation of investors through our digital assets offerings.”

Conclusion: Crypto Takes a Bigger Slice of Institutional Capital

BlackRock’s latest report signals a structural change in institutional investment behavior, where crypto is no longer a fringe asset. With crypto ETF inflows rising to 16.5% of total inflows, the sector is beginning to claim a larger share of portfolio allocations at the world’s largest asset manager.

As digital assets continue to gain momentum, BlackRock’s strategic focus and capital inflow data point toward a sustained rise in institutional crypto adoption in the quarters ahead.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.