Wall Street giants see blockchain tokenization as next leap after Bitcoin ETF success

BlackRock, the world’s largest asset manager, is reportedly weighing the tokenization of exchange-traded funds (ETFs) following the strong reception of its spot Bitcoin ETFs. The move would mark a significant step in merging traditional investment vehicles with blockchain infrastructure.

According to sources cited by Bloomberg, BlackRock is considering tokenizing funds with exposure to real-world assets (RWA). Such a shift could enable ETFs to trade outside of traditional market hours and even serve as collateral in decentralized finance (DeFi) applications.

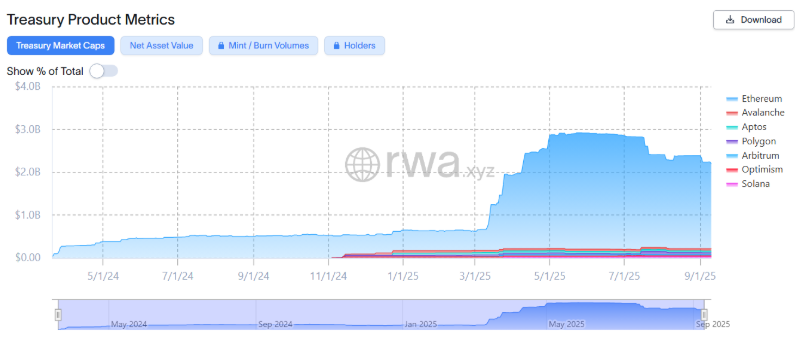

BlackRock already has experience in this area. Its USD Institutional Digital Liquidity Fund (BUIDL), launched earlier this year, has grown into the largest tokenized money market fund globally, with more than $2.2 billion in assets spread across Ethereum, Avalanche, Polygon, Aptos and other blockchains.

Industry momentum led by Wall Street

JPMorgan has called tokenization a “significant leap” for the $7 trillion money market fund industry, highlighting that it strengthens the role of cash-based instruments in digital markets. Teresa Ho, a strategist at JPMorgan, explained: “Instead of posting cash, or Treasurys, you can post money-market shares and not lose interest along the way. It speaks to the versatility of money funds.”

Other institutions are also pushing forward. Goldman Sachs and BNY Mellon recently unveiled a joint initiative allowing clients to hold tokenized money market fund shares directly on a private blockchain, with BlackRock expected to participate at launch.

Stablecoins and regulatory context

The tokenization push comes as traditional finance faces growing competition from yield-bearing stablecoins, which have attracted billions in liquidity. However, such tokens were left out of the U.S. GENIUS Act, the first comprehensive federal stablecoin bill.

Analysts believe the exclusion could reinforce institutional tokenization efforts. As one industry observer noted, “Stablecoin regulation may actually boost tokenization, since it creates clearer rules and safer pathways for institutions to enter blockchain markets.”

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.