IBIT joins U.S. T-bills and mega-cap technology equities as a key focus heading into 2026

BlackRock has positioned its spot Bitcoin exchange traded fund as one of its most important investment narratives, placing it alongside U.S. Treasury bills and leading American technology stocks. The move signals growing institutional confidence in Bitcoins long-term rolle within diversified portfolios, even amid short-term price volatility.

The asset manager identified its iShares Bitcoin Trust ETF (IBIT) as one of three dominant themes for 2025, grouping it with an ETF tracking short-term Treasury bills and another tied to the so called “Magnificent Seven” tech stocks. The inclusion places Bitcoin exposure on equal footing with some of the most widely held traditional assets.

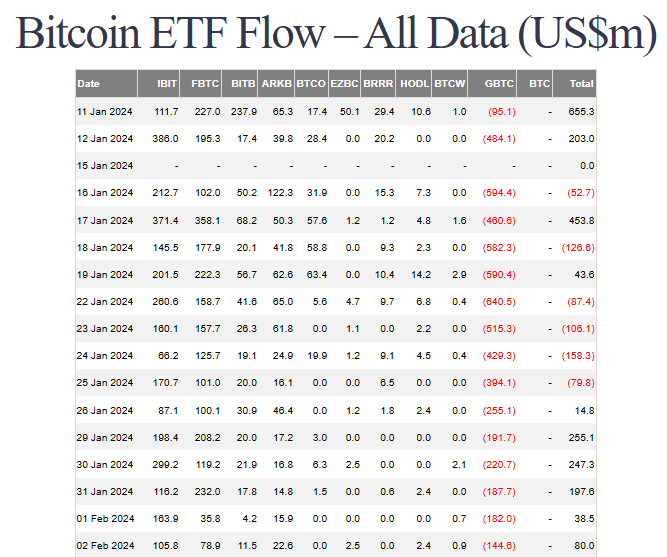

IBIT has recorded more than $25 billion in net inflows during 2025, ranking sixth among all exchange-traded funds by inflows, despite delivering a negative return for the year. This suggests that capital allocation decisions are being driven by long-term conviction rather than short-term performance.

Strong Inflows Despite Bitcoin Price Weakness

Bitcoin remains roughly 30% below its October peak, yet inflows into IBIT have remained resilient. Since launch, total net inflows into the fund have reached approximately $62.5 billion, far exceeding competing spot Bitcoin ETFs. IBIT’s cumulative inflows are more than five times larger than its nearest rival, underscoring its dominance in the market.

BlackRock has also broadened its digital asset strategy. Its Ethereum ETF has attracted over $9 billion in inflows this year, and the firm has filed for products incorporating staking and options-based income strategies.

While BlackRock has avoided launching funds tied to smaller cryptocurrencies, its continued focus on Bitcoin and Ethereum highlights a deliberate, measured approach to crypto adoption as markets move toward 2026.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.