Despite Bitcoin holding near $91K, IBIT logs its largest withdrawal since launch, while analysts say most ETF buyers remain near breakeven.

BlackRock’s flagship Bitcoin ETF, IBIT, saw a sharp reversal this week as it posted its largest single-day outflow since trading began in early 2024. The withdrawal—totaling $523.2 million—comes during a month already defined by unusually heavy redemptions across U.S. spot bitcoin ETFs. Yet, even amid the turbulence, market data suggests that the average investor remains close to breakeven, underscoring a complex shift in sentiment rather than outright panic.

Record Outflows Hit IBIT

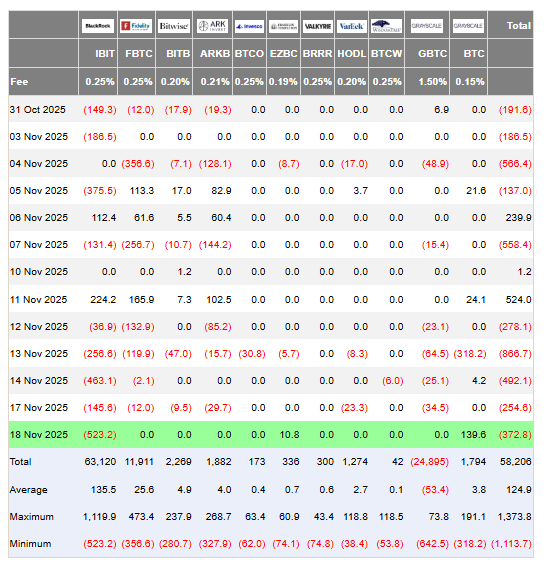

According to recent market data, IBIT recorded $523.2 million in net withdrawals on Tuesday, marking a new daily record for the fund. The outflow came despite Bitcoin’s price rising more than 1% and briefly breaking above $93,000.

A senior digital-asset strategist said the timing highlights a “growing disconnect between price movements and ETF investor behavior,” adding that institutional holders may be rebalancing portfolios rather than exiting due to fear.

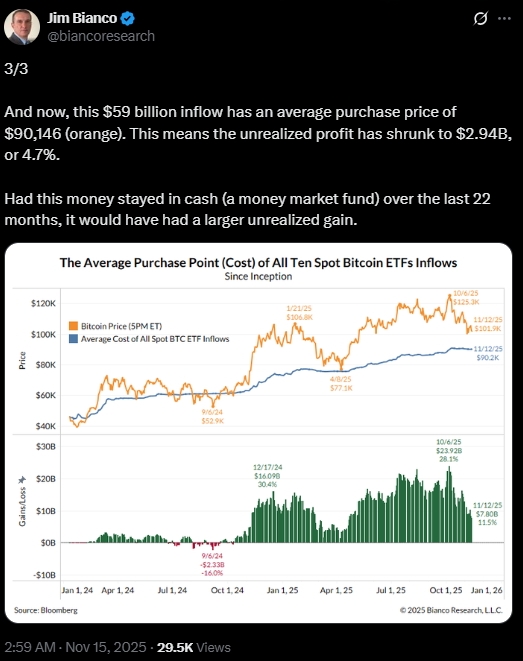

Economist Jim Bianco highlighted a key data point: the average purchase price of spot bitcoin ETF buyers since January 2024 sits at $90,146. With Bitcoin hovering slightly above that level, he said “the typical ETF holder is essentially flat,” a factor that may help stabilize fund flows in the coming weeks.

Other major products moved in the opposite direction. Franklin Templeton’s EZBC and Grayscale’s Bitcoin Mini Trust posted $10.8 million and $139.6 million in inflows, respectively. Even so, the overall ETF market ended the day with net outflows of $372.8 million, marking the fifth straight session of redemptions.

Bitcoin Near $90K as Investors Sit Around Breakeven

Bitcoin is trading near $90,000, roughly 30% below its October peak. Yet the industry has seen only a modest decline in ETF assets under management.

One market report noted that most selling pressure is occurring outside the ETF ecosystem, suggesting broader market forces—rather than ETF-specific catalysts—are driving Bitcoin’s recent cooling.

Pre-Market Movement

IBIT is currently down 1.5% in pre-market trading at $52, reflecting the broader uncertainty surrounding investor sentiment. Analysts say sustained volatility could continue to influence ETF flows as traders judge whether current prices represent a buying opportunity or a warning sign.

The record outflow from IBIT signals a notable shift in investor positioning, but not necessarily a collapse in confidence. With Bitcoin trading near the average cost basis of ETF buyers, market participants may be reassessing risk rather than abandoning exposure. How ETF flows respond in the coming days will be an important indicator of sentiment heading into year-end.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.