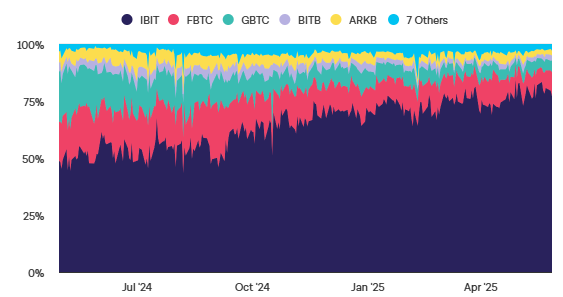

IBIT Leads the Way in U.S. Spot Bitcoin ETF Market

U.S. spot Bitcoin exchange-traded funds (ETFs) have witnessed a remarkable 10-day inflow streak, with net inflows totaling $4.26 billion as of May 28, 2025. The overwhelming majority of this capital — approximately 96% — has been driven by BlackRock’s iShares Bitcoin Trust (IBIT).

IBIT alone attracted $481 million in fresh capital on May 28, while other funds saw outflows or no activity at all.

This performance cements IBIT’s market leadership in the growing Bitcoin ETF sector, which has gathered over $45.6 billion in net inflows since its inception in January 2024.

33-Day Inflow Streak Without a Single Outflow

One of the most notable records for BlackRock’s IBIT is its 33 consecutive trading days with no net outflows since April 9.

During this streak, IBIT brought in a staggering $9.31 billion, contributing to its total $72 billion in assets under management (AUM).

IBIT now ranks among the top 25 U.S. ETFs by AUM — a rare feat for a fund launched just over a year ago.

Comparing IBIT With Competitors

While IBIT continues its meteoric rise, other Bitcoin ETFs are seeing mixed performance:

- Ark Invest’s ARKB experienced a $34.3 million outflow on May 28.

- Fidelity’s FBTC saw a $14 million outflow the same day.

- Other ETFs remained flat with zero net flows.

This emphasizes how BlackRock’s low-fee, trusted brand has become the preferred choice among institutional and retail crypto investors.

Analyst Commentary: A “Pac-Man” Performance

ETF analysts are astonished at the growth rate. Nate Geraci, President of The ETF Store, remarked:

“People once thought the entire Bitcoin ETF market might max out at $10 billion. IBIT alone has doubled that in under six months.”

Eric Balchunas, Bloomberg’s Senior ETF Analyst, noted:

“IBIT is now the youngest ETF in the top 25 AUM list. The next youngest is 12 years old.”

Conclusion

With Bitcoin prices consolidating near $108,000, and spot ETFs unlocking massive institutional flows, BlackRock’s IBIT is now the benchmark for crypto-backed investment vehicles.

Its sustained inflow streak and $72B AUM show that traditional finance’s embrace of Bitcoin is accelerating faster than ever.